At the 2026 World Economic Forum in Davos, former U.S. President Donald Trump spoke in support of nuclear energy. His remarks highlighted nuclear power as a key part of energy security and clean energy supply, saying:

“We’re very much into the world of nuclear energy, and we can have it now at good prices and very, very safe…the progress they’ve made with nuclear is unbelievable, and the safety progress they’ve made is incredible…”

After these comments, nuclear and uranium stocks moved higher in early trading. Investors showed renewed interest in nuclear companies, especially those developing advanced technologies like small modular reactors (SMRs).

Stocks such as Oklo Inc. (NYSE: OKLO), NuScale Power (NYSE: SMR), and Nano Nuclear Energy (NASDAQ: NNE) saw price increases as traders responded to the pro-nuclear sentiment. This trend shows how energy markets are changing.

Many investors now view nuclear energy as a stable, low-carbon power source. This is important as demand grows from data centers and industries.

Oklo Takes Center Stage in the Nuclear Trade

Oklo has become one of the most-watched nuclear stocks in 2025. Oklo’s shares jumped after it signed a big deal with Meta Platforms. They plan to build a 1.2 GW advanced nuclear energy campus in Pike County, Ohio.

The deal positions Oklo to supply clean, reliable power for Meta’s data centers. Analysts described this binding agreement as reducing some business risks for Oklo.

In January 2026, Oklo stock kept rising after President Trump’s pro-nuclear comments at Davos. It hit intraday highs around January 22, with gains across the sector. Bank of America upgraded Oklo to a Buy rating, setting a price target of $111. This shows strong confidence in Oklo’s data center partnerships and regulatory progress.

Cathie Wood’s ARK Investment increased its stake in Oklo. They bought over 34,000 shares. This shows a rising interest from institutions in advanced nuclear technology. This purchase followed earlier acquisitions valued at more than $8.9 million, showing sustained investment interest.

Strong Rallies, Sharp Pullbacks

Despite strong gains, Oklo’s stock price has also seen pullbacks. At times, shares fell nearly 10% in a single week due to profit-taking after earlier rallies. Investors sometimes respond to news about sectors. For example, competitive technologies like geothermal power can provide clean energy alternatives for data centers.

Oklo remains pre-revenue, meaning it has not yet begun large-scale power production. The company aims to build its first commercial microreactor system between late 2027 and 2028. Until that point, investor focus remains on contracts, partnerships, and regulatory progress.

SMRs and Speculation: Two Very Different Nuclear Bets

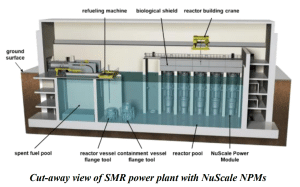

NuScale Power (NYSE: SMR) is another company that benefited from the nuclear rally after Davos. The company’s shares jumped around 15% on early trading days in 2026, along with sector momentum.

The stock is drawing investor interest because of the rising focus on small modular reactor (SMR) technology. SMRs may be easier to deploy and scale than traditional large plants.

NuScale’s SMRs got design approvals from the U.S. Nuclear Regulatory Commission (NRC). This boosts confidence in their technology. Analysts expect the company’s revenue to continue rising as project work expands.

NuScale is a great example of how modular nuclear designs can provide reliable power for industrial and data center needs. Regulatory milestones for SMRs may accelerate deployment timelines through the rest of the decade.

Nano Nuclear Energy: Early Stage, Strong Moves

Nano Nuclear Energy (NASDAQ: NNE) is a smaller player that also saw stock gains as part of the sector rally. Its shares rose roughly 40% in one trading week amid news of technology deals between U.S. and U.K. partners, and Trump’s recent announcement. This price movement reflected broader investor interest in nuclear technologies and potential future revenues.

Nano Nuclear is still in the early stages without significant revenue, similar to Oklo’s position. Its valuation illustrates how speculative nuclear stocks can be, driven by future expectations about technology deployment and regulatory support.

Why Nuclear Is Back on Investor Radar

Supportive government policy is a key driver for nuclear stocks. In 2025, the U.S. administration moved to speed up nuclear power development as part of a broader energy strategy. These moves include efforts to shorten licensing timelines and enhance domestic infrastructure for nuclear fuel and reactors. This policy backdrop helped lift stocks such as Oklo and NuScale.

President Trump’s Davos statements reinforced this trend by linking nuclear energy to national energy strategy and data center demand. Many investors view nuclear energy as a solution for rising electricity demands. This includes powering artificial intelligence and cloud computing infrastructure.

Nuclear power generates low-carbon electricity. This attracts companies that need to meet emissions targets while also dealing with growing power demand.

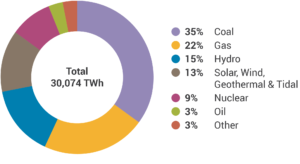

Globally, nuclear power already contributes a significant share of clean energy. According to the World Nuclear Association, nuclear energy generated about 9% of the world’s electricity from existing reactors. Supporters say that expanding nuclear power can meet future demand and reduce carbon emissions.

AI’s Power Hunger Fuels the Nuclear Case

The growth of data centers, particularly for AI, is driving interest in reliable baseload power. Tech companies, including Meta, have pursued long-term nuclear power agreements.

Meta has deals with companies like Oklo and TerraPower. These agreements aim to secure nuclear-generated electricity for its AI infrastructure. They involve spending tens of billions of dollars on building AI data centers. This corporate demand creates new business models for nuclear power. It makes future reactor deployments more financially viable.

Electricity demand from industrial and tech sectors continues to rise worldwide, increasing focus on clean, consistent power sources. Nuclear energy’s high capacity factor, meaning it can provide steady power output, is a key strength in this context.

What the Next Nuclear Decade Could Look Like

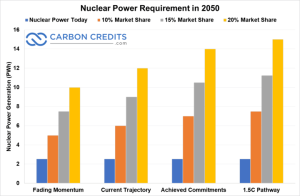

Industry analysts expect nuclear capacity to grow over the next few decades. Some forecasts tied to long-term pledges suggest that global nuclear capacity could triple by 2050 as part of decarbonization goals. This aligns with commitments from large utilities, governments, and corporate coalitions.

Stock forecasts differ, but long-term demand for nuclear reactors and fuel is expected to grow. This growth is driven by electrification and carbon reduction goals.

Small modular reactors are key to industry growth. They offer shorter construction times and lower upfront costs than large traditional reactors. If SMRs get regulatory approval and have stable supply chains, companies like Oklo and NuScale could start commercial operations in the 2030s.

Analysts provide mixed views on nuclear stocks. Many forecasts highlight the potential upside if technologies succeed at scale, especially for SMRs. Analyst price targets for NuScale Power suggest there is a lot of potential for growth from current prices.

A Renewed Nuclear Narrative

After President Trump’s supportive comments on nuclear energy at Davos, nuclear stocks climbed as traders reacted to potential industry growth. Oklo saw strong investor interest following major deals and institutional purchases. NuScale benefited from regulatory milestones and rising demand for modular reactors. Nano Nuclear showed how early-stage players can also capture attention.

Government support, corporate demand for reliable low-carbon power, and rising electricity needs from AI and data centers are key drivers behind the nuclear sector’s resurgence. Analysts still see challenges, but they expect nuclear capacity, especially smaller modular systems, to grow in the global energy mix.

The post Trump’s Davos Nuclear Endorsement Powers a Rally in Oklo, SMRs, and Atomic Stocks appeared first on Carbon Credits.