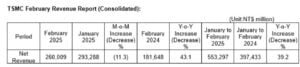

Taiwan Semiconductor Manufacturing Company (TSMC), the largest semiconductor foundry in the world, reported strong revenue growth in the first two months of 2025. The company earned NT$553.3 billion (US$16.81 billion), a 39.2% increase from last year. This growth is driven by the high demand for AI chips, especially from NVIDIA.

AI Demand Fuels TSMC Revenue Growth

In February 2025, TSMC’s revenue hit NT$260.01 billion, up 43.1% compared to last February. This marks the highest sales for February ever. However, it was an 11.3% drop from January 2025. Analysts expect revenue to rise in March, possibly exceeding NT$266.7 billion. This aligns with TSMC’s first-quarter sales goal of NT$820 billion to NT$846.24 billion.

As the main manufacturer of AI chips globally, TSMC is key to the tech industry. Its major clients include AMD, Apple, ARM, Broadcom, MediaTek, Qualcomm, and Nvidia. The growth of AI applications has increased chip demand, boosting TSMC’s expansion.

Massive U.S. Expansion Plans

The chip giant recently revealed it is expanding its U.S. operations with a $100 billion investment. This builds on its earlier $65 billion promise in Phoenix, Arizona. Now, the total is $165 billion. The expansion adds three new semiconductor plants, two packaging facilities, and a big R&D center. This marks the largest foreign direct investment in U.S. history.

The expansion can potentially create tens of thousands of high-tech jobs. It aims to generate over $200 billion in economic output in the next decade. Furthermore, the company can also strengthen its ties with top U.S. AI and tech firms like Apple, Nvidia, AMD, Broadcom, and Qualcomm.

However, a major challenge for TSMC in 2025 is the potential for U.S. tariffs on chip imports. Making news, TSMC’s CEO, C.C. Wei, met with former President Donald Trump at the White House. They talked about the investment and possibly addressed tariff concerns.

- READ MORE: NVIDIA Breaks Revenue Records as AI Demand Skyrockets, Targets 100% Renewable Energy in 2025

TSMC’s Path to Net Zero

TSMC has a clear roadmap to reach net-zero emissions by 2050. It launched Taiwan’s first Renewable Energy Joint Procurement Model. This model encourages suppliers to adopt low-carbon practices.

To support these efforts, TSMC released its first Climate and Nature Report in 2024. The company focuses on tech growth and caring for the environment. This way, it helps create a greener future.

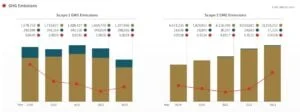

TSMC prioritizes sustainability through eco-efficiency initiatives. In 2023, it reported a 31% rise in unit GHG emissions per wafer but is committed to cutting overall emissions.

Global Energy Conservation with Advanced Technologies

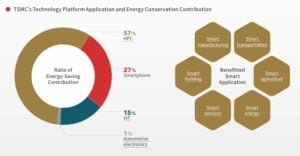

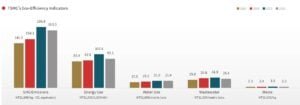

In 2023, TSMC implemented 822 energy-saving measures, saving 830 GWh of electricity and cutting NT$590 million in carbon costs through internal pricing.

Additionally, Taiwan’s Industrial Technology Research Institute (ITRI) estimates that TSMC’s innovations will boost global energy savings from 16.9 billion kWh in 2020 to 235.4 billion kWh by 2030.

More significantly, the company leads in energy-efficient semiconductor technology. Smaller, more efficient chips help devices use less power. With such innovations, TSMC leads in smarter manufacturing and industry-wide efficiency.

Sustainability Goals and Achievements

- Purchased 2,592 GWh of renewable energy, covering all overseas operations (11.2% of total use).

- Promotes closed-loop systems to recycle chemicals and packaging, making manufacturing more sustainable and energy-efficient.

- Increasing renewable energy usage in new 3nm fabs to over 20% and aiming to reach 60% across all operations by 2030.

- Replacing coal with cleaner natural gas and adopting carbon capture technologies to cut emissions. Lowering transportation emissions through greener logistics.

- Targeting 100% renewable energy globally by 2040—10 years ahead of schedule. It’s using low-carbon energy sources like wind and solar power while optimizing power consumption for greater efficiency.

- Reducing unit water consumption by 30% while boosting reclaimed water use by 60%.

Protecting Biodiversity

TSMC’s strong financial performance in early 2025 shows the rising demand for AI chips and its significance in the semiconductor industry. Despite a slight rise in emissions, it remains focused on emissions reduction and renewable energy adoption as part of its long-term sustainability strategy.

The post TSMC Dominates AI Chip Market with Record Sales—But Can It Its Tackle Rising Emissions? appeared first on Carbon Credits.