Uranium Energy Corp (UEC) announced that its Sweetwater Uranium Complex in Wyoming had been officially designated as a transparency project by the U.S. Federal Permitting Improvement Steering Council. This recognition comes under President Trump’s March 20, 2025, Executive Order aimed at accelerating domestic mineral production.

The decision allows Sweetwater to move through a fast-track permitting process, cutting project delays that are critical to national mineral and energy goals. Once upgrades are complete, Sweetwater will be the largest dual-feed uranium facility in the United States.

Significantly, it marks a major step toward restoring domestic uranium production and advancing U.S. energy security.

Trump Administration Presidential Appointee, Emily Domenech, Executive Director of the Federal Permitting Improvement Steering Council, highlighted:

“I am excited to welcome the Sweetwater Complex to the FAST-41 transparency dashboard in support of President Trump’s goal of unlocking America’s mineral resources. The uranium that this project can produce would be game-changing for our nation as we work to reduce our reliance on Russia and China, strengthen our national and economic security, and reestablish a robust domestic supply chain of nuclear fuel.”

UEC’s Strategic Acquisition Pays Off

UEC acquired 100% of Rio Tinto’s Wyoming uranium assets, including the fully licensed Sweetwater Plant and 175 million pounds of historic resources. This purchase added eight permitted and exploration-stage projects to UEC’s portfolio, strengthening its hub-and-spoke production platform in Wyoming.

The complex now boasts a licensed production capacity of 4.1 million pounds of U₃O₈ annually, giving UEC a significant position in the U.S. uranium supply chain. The upcoming TRS (Technical Report Summary), expected by the end of fiscal 2025, will formally outline the Great Divide Basin Hub-and-Spoke model, designating Sweetwater as the hub supported by multiple satellite mines.

Amir Adnani, UEC President and CEO, stated:

“Sweetwater’s selection under FAST-41 reinforces its national importance as a key project to achieve the United States’ goals of establishing reliable infrastructure, supporting nuclear fuel independence. Acquired from Rio Tinto in 2024, Sweetwater will be UEC’s third hub-and-spoke production platform, following operational advancements underway in Wyoming’s Powder River Basin and South Texas. On completing this tack-on permitting initiative, Sweetwater will be the largest dual-feed uranium facility in the United States, licensed to process both conventional ore and ISR resin. This will provide the Company unrivaled flexibility to scale production across the Great Divide Basin, leveraging UEC’s leading domestic resource base. We’re proud of and grateful for the Steering Council’s support under President Trump’s Executive Order to fast-track a secure, predictable, and affordable supply of critical minerals.”

Building a Scalable ISR Mining Platform

The company recently revealed that it is working to amend Sweetwater’s permits to include In-Situ Recovery (ISR) mining methods—an environmentally friendly and lower-impact uranium extraction process. The plan includes adding a new ion exchange and elution circuit at the Sweetwater Plant.

The “spokes” in this system will draw resources from:

- Red Desert deposits: REB, ENQ, and Sweetwater

- Green Mountain zones: Round Park, Phase 2, Whiskey Peak, and Desert View

- Other nearby deposits: JAB, Clarkson Hill, and Red Rim

This hub-and-spoke approach is designed to scale production while lowering costs and minimizing environmental disturbance.

Why Sweetwater Matters to U.S. Energy Policy?

The Executive Order that triggered Sweetwater’s fast-track status reflects a broader White House push to rebuild the nuclear fuel supply chain. The U.S. has been increasingly dependent on foreign uranium sources, making domestic production a matter of energy security.

By adding Sweetwater to the FAST-41 transparency dashboard, federal agencies are prioritizing faster reviews, more transparency, and better coordination for critical mineral projects. The Bureau of Land Management will serve as the lead agency for Sweetwater’s permitting process.

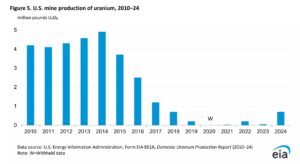

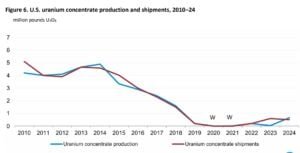

The chart from EIA’s Domestic Uranium Production shows that the U.S. uranium mines produced about 0.6–0.7 million pounds of U₃O₈ in 2024. This big drop over the years has made the U.S. more dependent on imported uranium.

That’s why the government is now pushing to boost local production. UEC’s Sweetwater Uranium Complex is part of that plan. Once upgrades are complete, Sweetwater’s estimate of 4.1 million pounds annually could be enough to cover most of today’s total U.S. uranium output on its own.

America’s Largest Licensed Uranium Complex

The Sweetwater Processing Plant is a 3,000-ton-per-day conventional uranium mill with full licensing and state permits in place. Once ISR methods are approved, Sweetwater will become the largest licensed uranium production facility in the country with dual-feed capability.

Key advantages include:

- Massive Resource Base – Over 175 million pounds of historic uranium resources

- Extensive Exploration Data – 6.1 million feet of historic drilling and ~108,000 acres under control

- Existing Permits – Approval already in place for conventional mining at Sweetwater, Big Eagle, and Jackpot mines

- Cost and Time Efficiency – Upgrading an existing plant is far faster and cheaper than building a new one, leveraging existing infrastructure for synergy and scale

The company also owns a high-grade Canadian project portfolio anchored by the world-class Roughrider deposit- one of the largest physical uranium stockpiles in the United States. In addition, it maintains a significant equity stake in Uranium Royalty Corp. This diversified portfolio would help UEC tap into opportunities from the growing global demand for uranium.

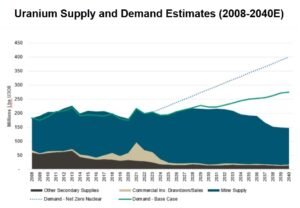

UEC Joins Global Push to Triple Nuclear Power by 2050

Nuclear power has long been the backbone of U.S. carbon-free electricity. According to the World Nuclear Association, in 2022, nuclear accounted for 19% of U.S. electricity generation—and 55% of the country’s carbon-free power. This avoided 482 million metric tons of CO₂ emissions, equivalent to removing about 107 million gasoline cars from the road for a year.

The push for nuclear energy has global momentum. At the COP28 climate summit in 2023, more than 20 nations agreed to triple nuclear capacity by 2050. UEC has pledged support for this international effort.

Green Mining Goals

UEC has committed to producing uranium under the highest environmental standards, aiming for net-zero CO₂ emissions across its U.S. ISR operations and maintaining zero significant environmental incidents annually.

The company’s air quality monitoring program reported no non-compliance in 2023. Radon and uranium particulate emissions were kept well below regulatory limits, with no harmful environmental releases.

This environmental track record supports UEC’s claim that ISR mining can be both commercially viable and environmentally responsible.

UEC Stock Market Momentum

UEC’s strong operational news has translated into equally strong stock performance. Over the past year, the share price has surged by approximately 114%, with gains of 51.8% in the past month and 14.1% in the past week alone.

On August 7, 2025, the stock reached a new 52-week high of $9.91 and is currently trading at around $9.85. Analysts remain bullish, citing sector optimism and positive policy developments, with most price targets above current levels.

However, they caution that high volatility remains due to the company’s current lack of profitability and its sensitivity to broader market shifts. In short, momentum is strong, but risk is real.

The Bigger Picture: U.S. Uranium Revival

Sweetwater’s fast-track designation signals more than just a win for UEC—it’s part of a national strategy to rebuild America’s nuclear industrial base. By unlocking domestic uranium resources, the U.S. can reduce its reliance on imports and strengthen its clean energy mix.

For UEC, it cements the company’s role as a leading domestic uranium supplier, capable of scaling production rapidly to meet future nuclear energy demand.

The post UEC Stock Surges as Sweetwater Uranium Project Gets Federal Fast-Track Approval appeared first on Carbon Credits.