Cameco delivered strong fourth-quarter and full-year 2025 results, with uranium clearly driving the story. As global nuclear momentum accelerated, utilities increased long-term contracting and focused more on supply security. In this environment, Cameco’s disciplined uranium strategy supported stronger earnings and reinforced its long-term positioning.

Strong Uranium Strategy Boosts Cameco’s Results

Uranium remains the foundation of Cameco’s business. Management continues to match production with long-term contracts instead of chasing short-term spot market gains. By the end of 2025, the company had about 230 million pounds of uranium under long-term contracts, giving it strong revenue visibility for years.

In 2025, uranium segment earnings before income tax increased by $50 million compared to 2024. Adjusted EBITDA rose by $76 million year over year. Although fourth-quarter earnings dipped slightly due to the timing of sales, adjusted EBITDA still improved, showing stronger underlying pricing.

This performance reflects contracts signed in a better uranium price environment. As higher-priced deliveries continue, margins should gradually strengthen.

Fuel Services and Westinghouse Support Solid Gains

- While uranium leads the story, Cameco’s fuel services segment also posted solid gains. Annual earnings before income tax increased by $71 million, and adjusted EBITDA rose by $74 million. Deliveries under contracts signed at improved prices drove the growth.

- Cameco’s investment in Westinghouse Electric Company further strengthens its nuclear exposure. For this segment, the adjusted EBITDA increased 30% compared to 2024. Cameco’s share of adjusted EBITDA rose by $297 million for the full year.

The company also received US$171.5 million from a cash distribution related to the Dukovany reactor expansion project in the Czech Republic. Dukovany Nuclear Power Plant is adding two new reactors, reflecting broader global nuclear expansion.

Although a similar distribution is not expected in 2026, Westinghouse continues to provide stable earnings and long-term value. Still, uranium production and contracting remain Cameco’s primary earnings engine.

Cameco (NYSE: CCJ) Stock Reflects Uranium Momentum

Cameco is trading around $116.50 USD per share, close to multi-year highs. Over the past year, the stock has surged roughly 140%, largely driven by rising uranium prices and renewed nuclear policy support.

Recent trading has shown normal volatility, typical of resource stocks. However, analysts say long-term sentiment remains bullish. They continue to maintain positive ratings, supported by strong uranium fundamentals, improving earnings, and structural growth in nuclear demand.

- CHECK: LIVE URANIUM PRICES

Is Cameco Set to Ride the Nuclear and Uranium Boom?

As nuclear capacity expands globally, uranium demand is expected to rise steadily. However, supply growth remains measured and capital-intensive. This dynamic supports a constructive multi-year uranium cycle.

The International Atomic Energy Agency forecasts that global nuclear capacity could double by 2050, reaching 561–992 gigawatts. This expansion will require a reliable uranium supply for decades.

In 2025, the uranium market strengthened. Governments renewed support for nuclear energy, and utilities increased long-term contracting. Energy security and decarbonization goals made uranium a priority once again.

At the same time, supply remains tight. Secondary uranium sources are shrinking, and new mines face long development timelines, rising costs, and geopolitical risks. This supply-demand gap is pushing long-term uranium prices higher.

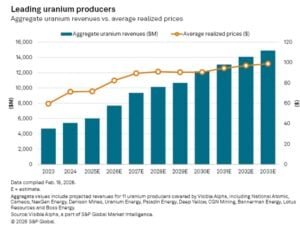

- Analysis from Visible Alpha, part of S&P Global Market Intelligence, shows that uranium revenue across 11 major listed uranium producers could grow from $4.7 billion in 2023 to $14.9 billion by 2033.

- Most of this growth is expected in the second half of the decade, as new mines come online.

Higher production and stronger prices will fuel industry growth. Average uranium prices are expected to rise from $59.6 per pound in 2023 to $98.7 by 2033, with the potential for further increases after that.

Cameco’s disciplined approach positions it well in this environment. The company avoids overproduction, protects its top-tier assets, and maintains financial strength. Rather than chasing volume, it focuses on long-term contracts and sustainable value creation.

Uranium Titans Face Off: Kazatomprom vs. Cameco in 2025

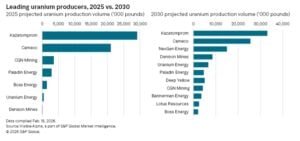

Despite rising interest in new uranium projects, the market remained highly concentrated in 2025. Kazakhstan’s Kazatomprom and Cameco continued to dominate both revenue and production.

Consensus forecasts from Visible Alpha estimate Kazatomprom will generate around $3.3 billion in uranium revenue in 2025. In comparison, Cameco is projected to earn roughly $2.1 billion.

Uranium forms the core of both companies’ business models. It accounts for about 91% of Kazatomprom’s revenue and 83% of Cameco’s revenue. Therefore, both miners remain highly sensitive to uranium price movements and contract renewals.

Production and Revenue Show a Clear Divide

In production terms, Kazatomprom is expected to produce 29.1 million pounds of uranium in 2025, while Cameco is forecast to deliver around 21 million pounds. Together, they represent roughly 86% of total output among the seven largest uranium producers.

The comparison highlights Kazatomprom’s scale advantage in both revenue and output. However, Cameco maintains a strong position in Western markets, long-term utility contracts, and strategic supply agreements.

Looking ahead, competition may intensify after 2028. A new wave of uranium miners is projected to significantly expand supply, with total output forecast to rise from 58.5 million pounds in 2025 to 141.2 million pounds by 2033. This shift could gradually reshape the uranium market’s competitive balance.

Overall, with global nuclear expansion underway, uranium will remain a critical energy resource. Cameco (NYSE: CCJ) is strategically placed to benefit from rising uranium demand while navigating market volatility.

The post Uranium Rally Lifts Cameco Stock (CCJ) After Strong 2025 Results appeared first on Carbon Credits.