[Disclosure: AgFunderNews’ parent company is AgFunder.]

After a few tough years of macroeconomic turbulence marked by stubborn inflation, costly credit, and ongoing trade uncertainties, the US agrifoodtech investment scene showed cautious signs of recovery in 2024—with artificial intelligence emerging as a key catalyst.

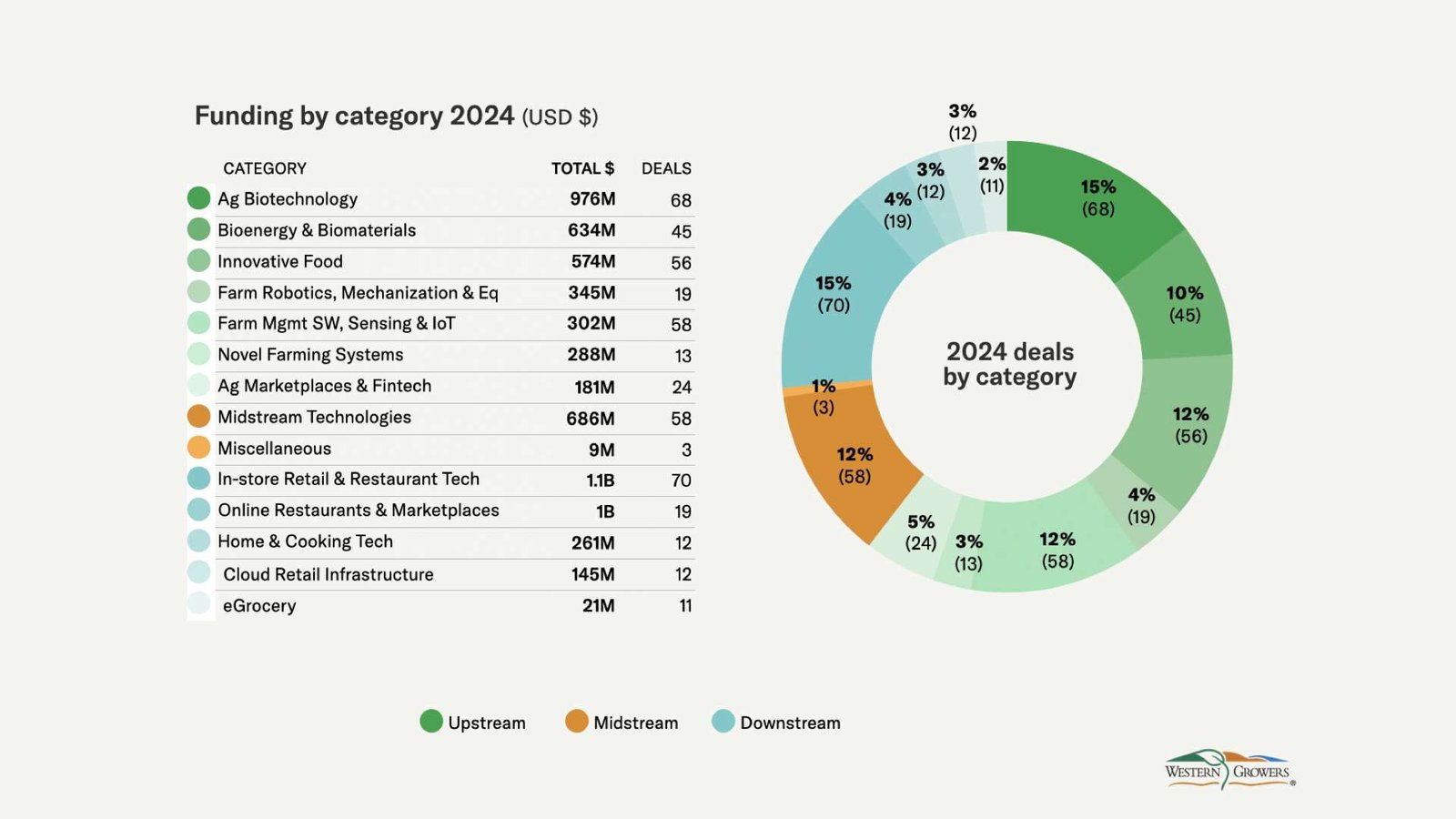

US agrifoodtech startups raised $6.6 billion in 2024, up 14% from the prior year’s $5.8 billion, according to AgFunder’s latest Global AgriFoodTech Investment Report.

The figures remain significantly below the exuberant highs of 2021, when US agrifoodtech raised $26 billion before interest rate hikes and valuation corrections ended the cheap-money era. Notably, the number of deals in 2024 fell to a decade-low 468, highlighting investors’ continued selectivity and prioritization of strong unit economics.

But, given US venture capital trends are often a precursor to those elsewhere, the uptick in US investment in 2024 could signal a stabilization point for the sector globally.

One standout trend, reflective of the broader venture capital sentiment, is the increasing concentration of dollars in artificial intelligence. AI has emerged as the lone bright spot in a challenging venture environment, attracting over $100 billion across industries in 2024, according to Crunchbase, or about one third of all venture capital raised that year.

Within agrifoodtech, this AI enthusiasm manifests in startups ranging from farm robot pioneers like Monarch Tractor and Carbon Robotics—both leveraging AI-powered automation to tackle persistent labor shortages and efficiency gaps—to supply chain optimizers such as Odeko, which deploys predictive algorithms to streamline restaurant logistics.

“Looking at cold inbound pitches, I’m seeing a striking number of founders branding—or rebranding—themselves as AI companies,” says AgFunder founding partner Rob Leclerc. “AI is eating VC dollars.”

Reflecting that, 13 out of the top 20 deals for US agrifoodtech in 2024 went to startups that make some use of AI, or at least mention it. While this doesn’t say much about actual deployment (it’s easy to talk about AI, much harder to implement it), it does underscore investor interest in the sector as it relates to agrifood.

Wonder, which raised $700 million in 2024, is building a “superapp” for food in which AI will tell users what they want to eat and automatically order it (from Wonder, of course). CEO Marc Lore has even said that 85% to 90% of own his meals are “AI derived.”

Further upstream, seed gene-editing startup Inari uses what it calls “AI-powered predictive design” to discover new genetic pathways and predict where and how to make edits within plants’ DNA to enhance performance. Oishii, meanwhile, utilizes AI to power its robotics-equipped vertical farm that grows high-end strawberries.

Weeding robots show ‘most progress’

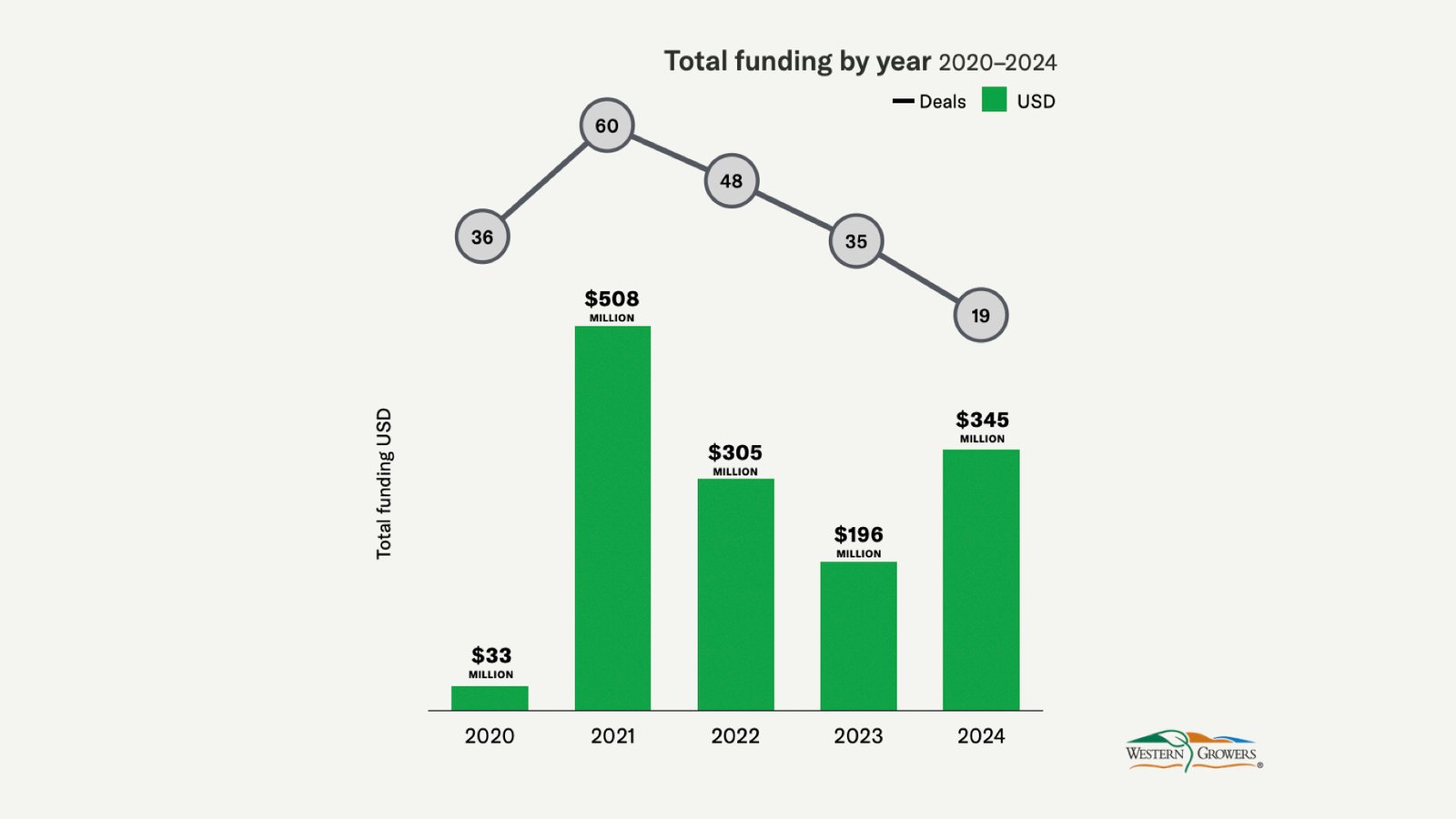

After raising a modest $33 million in the early days of 2020, investment in US-based Farm Robotics, Mechanization & Equipment startups exploded more than 1000% during the funding heyday of 2021.

While the number of deals has since cooled, total funding for the category increased in 2024, reaching $345 million in 2024 versus $196 million in 2023 and $305 million in 2022, based on larger and later-stage deals as the category matures.

Walt DuFlock, VP of innovation at trade association Western Growers, a partner of AgFunder’s report, says this smaller deal count is in line with overall VC trends, “including a preference for many funds to invest further in existing portfolio companies over investing in new startups.”

“It does not necessarily mean progress is slowing, only that funds are moving towards later stage activity,” he adds.

The two top-funded companies—Monarch Tractor ($133m Series C) and Carbon Robotics ($70m Series D)—presented real results in 2024 in terms of deployment in the field for their autonomous tractor and autonomous weeding technologies, respectively. Monarch says it has deployed 400 machines globally, while Carbon Roboitcs has more than 100 of its weeders with customers.

Successful ag robotics startups are the ones in weeding, spraying, thinning, and harvest-assist segments, says DuFlock.

“Weeding robots are showing the most progress at this point, with laser-weeder manufacturer Carbon Robotics in the lead with over 100 robots delivered to customers and expected sales growth for 2025. Spraying startups, including GUSS and Ecorobotix, are seeing good traction with growers. Harvest assist, with Burro, continues to develop into a nice segment. Those four companies are all delivering machines into market.”

Weeds are a costly challenge for US farmers, driving the market pull for these products. They decrease crop yields in the United States by an annual average cost of $33 billion, according to the United States Department of Agriculture. Weed control activities cost around $6 billion annually and include the use of potentially harmful pesticides that consumers are increasingly against.

Meanwhile, growers are losing access to various synthetic herbicide solutions as regulations tighten and consumers demand “cleaner” food. Labor shortages are ever present, and, at a basic level, weeding is simply an easier task to automate than, say, harvesting.

“It’s really hard to build an end effector that can do the very delicate job of picking fruits and vegetables and putting them into storage bins without damaging them at a significant rate,” says DuFlock. “Both the hardware and the software for harvesting robots are challenging.”

Paul Mikesell, CEO and founder of Carbon Robotics, says growers “aren’t just interested in AI-powered technology, they’re using it every day,” particularly for weeding.

“With more than 100 LaserWeeders deployed across three continents and demand growing fast, it’s clear that farmers aren’t waiting for the future of farming – it’s happening now,” he tells AgFunderNews.

“AI-powered farming is here, it works, and it’s making a real difference. Farmers are cutting labor costs, improving efficiency, and eliminating herbicides with automation that actually fits their operations.”

“This is about more than replacing herbicides,” he adds. “It’s about giving farmers the tools they need to stay competitive and keep their operations running profitably in an industry that’s under a lot of pressure with rising costs.”

Picks and shovels rule restaurant tech

Once upon a time, back in 2021, restaurant tech funding was overwhelmingly about ghost kitchens. It was a flashy new concept that raised almost $5 billion worldwide that year and gave a lockdown-fatigued planet reason to get excited about food.

Like many Covid-era technologies, ghost kitchens were less flashy and more flash-in-the-pan in reality, eventually losing investor and consumer interest and largely fading into the background.

Cloud Retail Infrastructure—the category for ghost kitchens and other tech services for at-home dining—raised just $145 million in 2024 in the US.

In contrast, US In-store Retail & Restaurant Tech, raked in $1.1 billion.

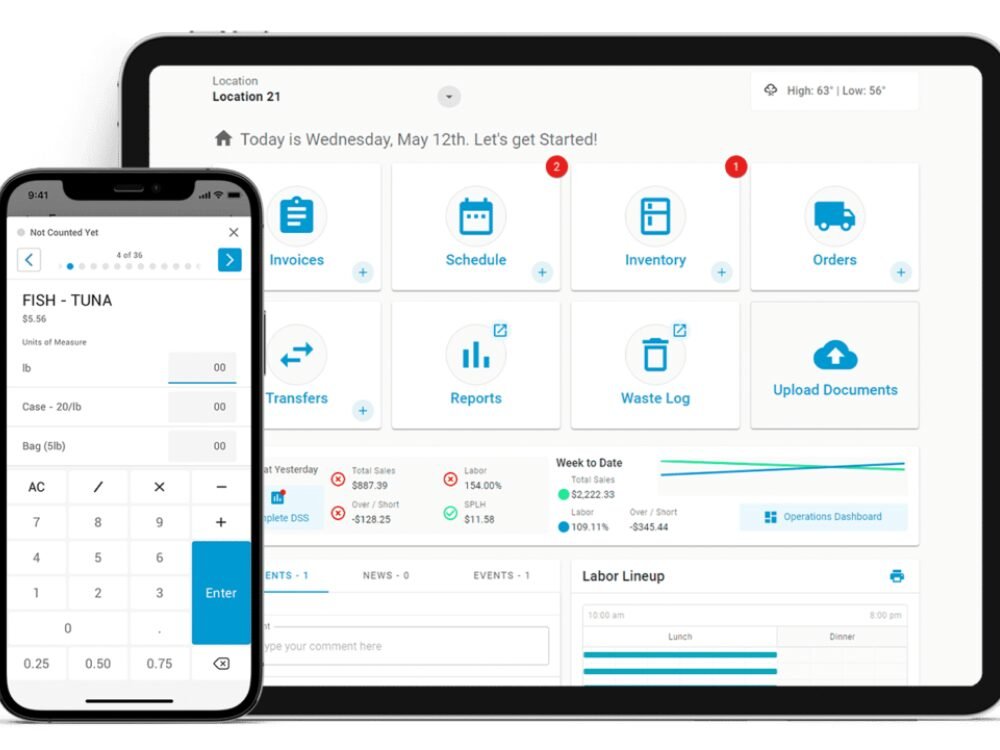

The latter category has never been flashy to consumers or investors. Made up largely of management and automation systems for staffing, inventory, accounting, and other routine restaurant tasks, it’s more a “picks-and-shovels” category. Cutting costs and improving efficiency are its goals, both of which can save a restaurant’s bottom line but aren’t likely to become Tik Tok videos. Or as Forbes put it back in 2019, restaurant tech is “boring but revolutionary.“

Illustrating this, Restaurant365 offers an “all in one” restaurant management platform that can, with the help of AI, automate everything from scheduling to inventory tracking. The California-headquartered company raised $175 million in 2024 at a $1 billion-plus valuation. Odeko, which offers something similar but with a specific focus on small businesses like coffeeshops, raised $150 million, according to AgFunder data.

Falling from grace

It was sadly a foregone conclusion that some categories would perform poorly in the US in 2024. Novel Farming Systems, which includes insect farming and vertical farming, two sectors that are struggling, raised just $288 million, a 53% decline from 2023.

Ag Marketplaces & Fintech saw even lower numbers, with $181 million raised. While the category is one of the biggest in developing markets, where poor supply chain infrastructure calls out for efficiencies, it has never really taken off in the US. In fact, it’s been associated with some of agtech’s biggest disappointments (ahem Indigo Marketplace and Farmers Business Network). The market need is far less when farmers are generally able to access inputs and sell their wares fairly efficiently each year.

The eGrocery category had the longest fall. The top category for several years running, it raised $4 billion in 2021 and $1 billion in 2022, with investment dropping to just below $1 billion in 2023.

In 2024, US eGrocery startups raised just $21 million as industry behemoths dominate the space; Amazon Fresh is the clear market leader for online grocery, followed by Walmart and surprisingly Walgreens, which is best known for pharmaceuticals. The original eGrocery startup Instacart has maintained around 20% market share in the past few years, but few others survived. Only if and when entrepreneurs can come up with something novel and better than the incumbent eGrocers are we likely to see more activity in this category.

California king?

California has led US investment for years, and 2024 was no different, with the Golden State raising $1.9 billion, up from $1.8 billion in 2023 but down from $6 billion in 2022.

New York typically trails right behind California, with $1.5 billion in deals in 2024, up from a mere $663 million in 2023.

One question is whether California—home to Silicon Valley—will remain the top state for investment as new capital models come to agrifoodtech and more players begin to question whether the traditional VC model is appropriate for the space.

On the flip side, Silicon Valley is effectively powering the so-called “AI revolution,” including many enabling technologies that could make their way into agrifoodtech. California is also home to the vast majority of specialty crop production in the US (e.g., strawberries, almonds, olives), where robotics and autonomy are making heavy inroads. For now, at least, these factors will likely keep the state at the top when it comes to agrifoodtech investment.

The post US agrifoodtech funding up 14% driven by investment in AI-related startups appeared first on AgFunderNews.