Happy Monday!

Last week, the US took a French exit from the Paris Agreement, with echoes across global carbon markets: cutting future demand, narrowing supply pathways, and opening a $10–25bn climate finance gap.

In deals, $2bn for data center development, $900m for uranium production development, and $865m for solar & battery asset transitions.

In other news: the post-Maduro Venezuela oil plays, the DOE’s funding for nuclear fuel, and Meta goes nuclear.

And catch the download live with our webinar on January 15, at 11 am EST. Hear firsthand from Sightline co-founders, Kim Zou and Mark Taylor; Sightline research director, Julia Attwood; and CTVC co-founder, Sophie Purdom. Sign up here.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals and announcements for the newsletter at hello@ctvc.co.

💼 Find or share roles on our job board here.

CTVC is powered by Sightline, the tactical market intelligence platform for energy and investment decision-makers.

The US UNplugs from the climate system

Last week, the Trump administration withdrew the US from key United Nations climate agreements and governing bodies, the unsurprising endpoint of its long retreat from multilateral climate engagement, including Trump 1.0’s exit from the Paris Agreement.

But this is one of the US’s biggest steps back from the international climate arena yet: It has now removed itself from the core systems that coordinate emissions reporting, climate finance, and international carbon markets.

What happened

President Donald Trump signed an executive order suspending US participation in a laundry list of 66 international organizations, agencies, and commissions, including the UN Framework Convention on Climate Change (UNFCC), the UN Population Fund, and a wide range of UN-affiliated agencies focused on climate, labor, migration, and development.

Perhaps the most significant exit is from the UNFCCC, the 1992 treaty that underpins global climate negotiations and the Paris Agreement. In doing so, the US cuts off formal participation in rule-setting around emissions accounting, climate finance flows, and cross-border carbon credit mechanisms.

The legal footing remains uncertain, as the UNFCCC is a Senate-ratified treaty approved under President George H. W. Bush, and whether a president can unilaterally withdraw is unresolved. While the treaty requires a one-year notice period, the financial and geopolitical consequences begin immediately.

Why it matters

Since 2014, the US has pledged more than $6bn to the UN Green Climate Fund and delivered roughly $2bn to date, with additional funding flowing through UN-linked climate finance programs. The US has also provided ~30% of all voluntary contributions to the Intergovernmental Panel on Climate Change, the UN’s central climate science body, which it now plans to exit. These institutions will feel the funding shock quickly.

Equally importantly, it shifts influence. The US is ceding climate leadership, but the vacuum will not remain empty. The EU and China gain more room to define emissions accounting and market design that increasingly function as global defaults, ones many US companies and investors will still follow.

It’s a soft power play with material impacts. They show up most clearly in carbon markets, hitting both sides of the market at once: what US projects can supply, and who shows up to buy.

Supply

Many US carbon project developers were building toward international compliance end markets, which command higher prices than voluntary markets and offer durable, policy-backed demand. But Article 6 of the Paris Agreement defines how international carbon markets work. It determines which carbon credits qualify for cross-border trade and compliance use, and how emissions reductions are accounted for. Those standards are still being negotiated.

Now the US is giving up its seat at the table, likely closing the door for US projects’ eligibility in compliance markets (“making a corresponding adjustment under Article 6 of the Paris Agreement,” in technical terms). Developers of long-lived assets like DAC, CCS, or BECCS could no longer sell to institutional buyers mandated to align their credit purchases with Article 6 criteria, and it’s just as the EU opens up for more international credits.

US state carbon markets already blinked: California’s prices fell more than $1.00 on January 8, as investors priced in growing isolation from international linkage and heightened legal risk for programs like California’s Cap-and-Invest and RGGI.

Meanwhile, voluntary carbon markets remain open, but the ceiling is lower. US projects can still issue credits through private standards like Verra, Gold Standard, ACR, and CAR, and corporates can still buy them. But without UN participation, those credits lack Paris alignment, host-country authorization, and corresponding adjustments, reducing the size of the market.

Demand

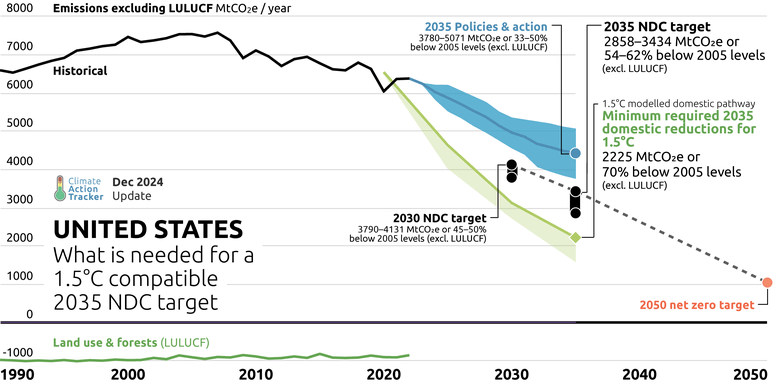

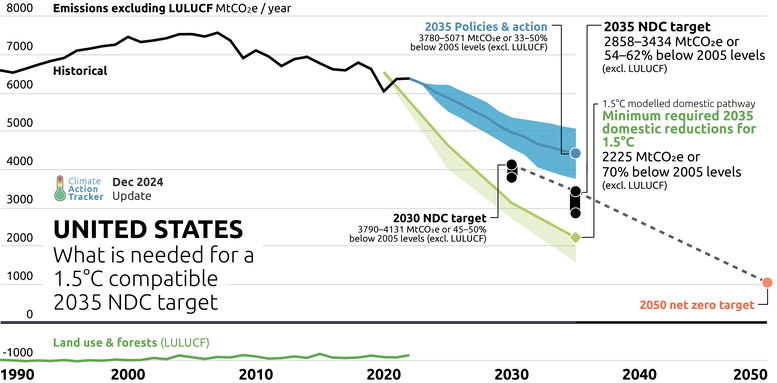

Additionally, the US will likely no longer buy Article 6 credits to meet its climate goals, if it doesn't care about its goals altogether. The US — the world’s second largest emitter — would have been among the largest future buyers. According to the previous administration’s NDCs, the US would have bought around 1GTCO2e (1bn credits) to reach 0 by 2050; with an average price of $10-25/tCO2, that turns into a $10-25bn gap in climate finance.

Leaving these groups, the US won’t have to offset national emissions, or even report them to the IPCC, a significant change for the world’s second-largest annual emitter. And if the biggest buyer pulls out, prices could fall globally from lower demand, making it less appealing for carbon developers to enter the market.

Key takeaways

- Rule-makers vs. rule-takers: Other jurisdictions are moving ahead. The EU is integrating carbon removals into its ETS, and China is increasingly participating in global climate conversations. Countries that stay inside the UN system shape the rules, set the standards, and attract capital, while the US falls behind and misses out.

- Voluntary-only risk: Without access to compliance markets, the US risks becoming a voluntary-only carbon market: more fragmented, more price-sensitive, and more exposed to scrutiny around double-counting and integrity claims.

- Offtake slowdown. Developers such as Drax, the UK-based electricity producer looking to develop BECCS projects in the US owing to biomass availability, may struggle to get demand from US voluntary buyers, or to trade those credits back into the UK for compliance offsetting if UK rules require alignment to the Article 6 mechanism.

Deals of the Week (1/5-1/12)

Late-Stage / Growth

🏠 DayOne, a Singapore‑based data center developer and operator, raised $2bn in Series C funding from Coatue and INA.

🔋 ReElement Technologies, a Fishers, IN‑based recycling rare earths and battery metals service provider, raised $200m in Growth funding from Transition Equity Partners.

🔋 Azimuth AI, a Santa Clara, CA‑based embedded silicon product developer, raised $130m in Growth funding from Jetha Global, Impact Ventures (AUS), and Moneta Ventures.

🧪 Photonic, a Coquitlam, Canada‑based scalable quantum computers developer, raised $130m in Growth funding from Planet First Partners, BCI, Microsoft, Royal Bank of Canada, and Telus.

🏗 Cambium, a Baltimore, ML‑based sustainable building materials supplier, raised $100m in Series B funding from 8VC, Alumni Ventures, Lockheed Martin Ventures, MVP Ventures, Veteran Ventures Capital, and other investors.

⚡ Renewable Properties, a San Francisco, CA‑based commercial solar project developer and investor, raised $40m in Growth funding from AB CarVal.

⚡ Renewco Power, a Glasgow, Scotland‑based utility‑scale renewable projects developer, raised $39m in Growth funding from Scottish National Investment Bank and SSE

Early-Stage

🛰 Array Labs, a Palo Alto, CA‑based satellite‑based 3D imaging software developer, raised $20m in Series A funding from Catapult Ventures, Aera VC, Animal Capital, KOMPAS, Y Combinator and other investors.

🌾 Biographica, a London, England‑based machine learning‑driven crop genetics software, raised $10m in Seed funding from Faber Ventures, Cardumen Capital, Chalfen Ventures, Entrepreneur First, SuperSeed Ventures, and The Helm.

🌾 Bloemteknik, a Cardiff, Wales‑based horticultural lighting solutions designer, raised $4m in Seed funding from Foresight Group.

💨 Black Bull Biochar (BBB), a London, England‑based biochar‑based agriculture carbon removal service provider, raised $3m in Seed funding from TSP Ventures, Greater Manchester Combined Authority, and Old College Capital.

Other

⚡ Orano, a Paris, France‑based nuclear energy solutions provider, raised $900m in Grant funding from the US Department of Energy (DOE).

⚡ Exus Renewables, a Madrid, Spain‑based renewable energy asset developer and manager, raised $400m in PF Debt funding from Barclays, ING Capital, Nomura, Santander, BHI, and KeyBanc Capital Markets.

⚡ Juniper Green Energy, a Gurgaon, India‑based renewable energy power producer, raised $226m in Debt funding from Aseem Infrastructure Finance, Barclays, DBS Bank, HSBC, and NaBFID.

☀️ Waaree Energy Storage Systems, a Mumbai, India‑based energy storage solutions provider, raised $111m in PF Equity funding from undisclosed investors.

🏗 Aisti, a Jyväskylä, Finland‑based carbon negative acoustic tiles manufacturer, raised $23m in Debt funding from European Investment Bank (EIB).

Exits

🚆 ioki, a Frankfurt am Main, Germany‑based mobility analytics and autonomous driving developer, was acquired by BENTELER Group for an undisclosed amount.

🚢 Njord, a Copenhagen, Denmark‑based maritime emission reductions service manager, was acquired by V.Group for an undisclosed amount.

🌬 IWS Services, an Oslo, Norway‑based offshore wind maintenance and electrical service provider, completed a Merger under the IWS Services banner with Hyndla and ProCon.

🌱 Plan A, a Berlin, Germany‑based corporate carbon footprint tracking platform, was acquired by Diginex Limited at an implied valuation of $64m.

Funds

💰 Taaleri Energia, a Helsinki, Finland-based renewable energy fund manager, raised its final close of $736m for its SolarWind III Fund from investors including Erste Group, EBRD, EIF, Ilmarinen, and KBC Verzekeringen, focusing on utility-scale wind, solar, and battery storage across Europe and Texas.

This is a sample of deals available for Sightline clients. Can’t get enough deals?

In the News

The Trump administration moved quickly to explore a cooperative oil deal with post-Maduro Venezuela, convening oil executives and authorizing US firms to help revive production and take up to 50m barrels as Washington eases select sanctions. Oil majors warned Venezuela remains commercially and legally uninvestable without deeper political reforms, debt restructuring, security guarantees, and reduced state control. The episode shows geopolitical shifts can reopen fossil fuel supply in the short term, but structural risks constrain any durable oil resurgence during the energy transition.

In other US news, the US awarded $2.7bn to three nuclear fuel makers to restart domestic uranium enrichment and fuel production: American Centrifuge Operating, General Matter, and Orano Federal Services. The funding will support new capacity for both low-enriched uranium (used by existing reactors) and high-assay low-enriched uranium (for advanced reactors), to reduce reliance on Russian nuclear fuel. The move reflects domestic energy security priorities as electricity demand from AI and data centers rises.

In more nuclear news, Meta signed long-term nuclear power agreements totaling up to about 6.6GW by 2035, including 20-year PPAs with Vistra’s Perry, Davis-Besse, and Beaver Valley plants, plus pre-purchase deals with TerraPower (2.8GW) and Oklo (1.2GW). The strategy reflects nuclear’s role in meeting hyperscaler electricity demand, while also supporting plant uprates, life extensions, and the development of next-gen nuclear reactors, with Big Tech at the forefront.

Utility Portland General Electric is increasing prices on more than 1GW of battery storage projects, citing higher costs. The hikes affect three projects from its 2023 all-source RFP, as tariff risks and changing investment tax credit eligibility push storage and solar-plus-storage costs up more than 60%. The move shows how shifting US trade and tax policy is driving up clean energy costs and raising cancellation risks despite broad support for storage expansion.

Seed company Corteva and bp launched a new JV to produce biofuel feedstocks from crops such as canola, mustard, and sunflower, targeting 1m metric tonnes of feedstock annually by the mid-2030s. With subsidies for crop-based biofuels in the US (but notably not the EU), it will likely be to supply sustainable aviation fuel and renewable diesel.

New financing and insurance packages for reducing exploration risk in deep geothermal projects are launching in Germany and the Philippines. Exploration is often the most risky and expensive stage in geothermal, so these programs combine low-interest loans with exploration risk cover to partially insure drilling costs and allow partial debt waivers if wells fail. De-risking early-stage exploration can help unlock scalable geothermal projects.

France unveiled revised rules for its planned 1GW national clean hydrogen subsidy auctions, removing RFNBO requirements and decoupling financial support for green and nuclear hydrogen from market price-linked mechanisms. It’s a departure from the EU’s strict hydrogen rules and offers greater revenue certainty and potentially higher subsidies to accelerate domestic hydrogen production.

Pop-up

Ratepayers felt the current shift as utilities powered up to $34bn in new rates in the first three quarters of 2025, up $16bn over the same period of 2024.

The DOE made a Trump-themed 2025 Wrapped.

A US CBAM proposal.

Vertical farms reach new heights in Singapore as the world’s biggest opens.

Going with the flow: Hong Kong-based vanadium flow battery company Rongke Power deployed the world’s first vanadium flow battery at gigawatt-hour scale.

The market traffic signals, one year into congestion pricing in New York.

A fuel cell that can run on soy sauce.

After $9bn and 40 years, salmon recovery swims upstream into a sea-lion roadblock.

Toad vs. road in Ecuador.

Opportunities & Events

💡 Climatebase Fellowship – Cohort 9: Apply for the priority deadline of January 12th or final deadline of February 23 to join a 12-week accelerator for professionals seeking careers in climate, featuring expert-led curriculum, startup and project support, and access to a network of climate leaders.

📅 The National Climate Tech Accelerator, Manchester: Celebrate the launch of a new accelerator by Sustainable Ventures and Barclays Eagle Labs supporting UK climate tech startups on January 28 in Manchester.

📅 DISTRIBUTECH International 2026: Join us on February 2–5 in San Diego, CA for the leading annual event for transmission and distribution innovation in the energy sector.

💡 Global Ocean Innovation Challenge: Apply by February 6 to pilot ocean-focused technologies with The Nature Conservancy, YKAN, and Newlab, targeting marine biodiversity, enforcement, and data innovation in Indonesia and the Asia Pacific.

💡 Go Make 2026: Apply by March 10 to participate in a catalytic innovation accelerator by Greentown Labs, Shell, and Technip Energies supporting startups advancing low-carbon fuels, sustainable chemical manufacturing, and CO2 removal.

Jobs

Senior Software Engineer, @Sightline Climate

Platform Engineer, @Sightline Climate

Robot Software Engineer (Platform and Backend), @Planted

Robot Software Engineer (HMI/UI), @Planted

Investment Associate, @Zero Infinity Partners

Electrical Engineer, @Planted

Civil Engineer, @Planted

Solution Engineer, @Planted

Summer Research Analyst – Environmental Markets, @Molecule Ventures

Senior Full-Stack Engineer, @Coral

Full Stack Engineer, @Möbius Industries

Part-Time Inside Sales Representative, @Composer

📩 Feel free to send us deals, announcements, or anything else at hello@ctvc.co. Have a great week ahead!