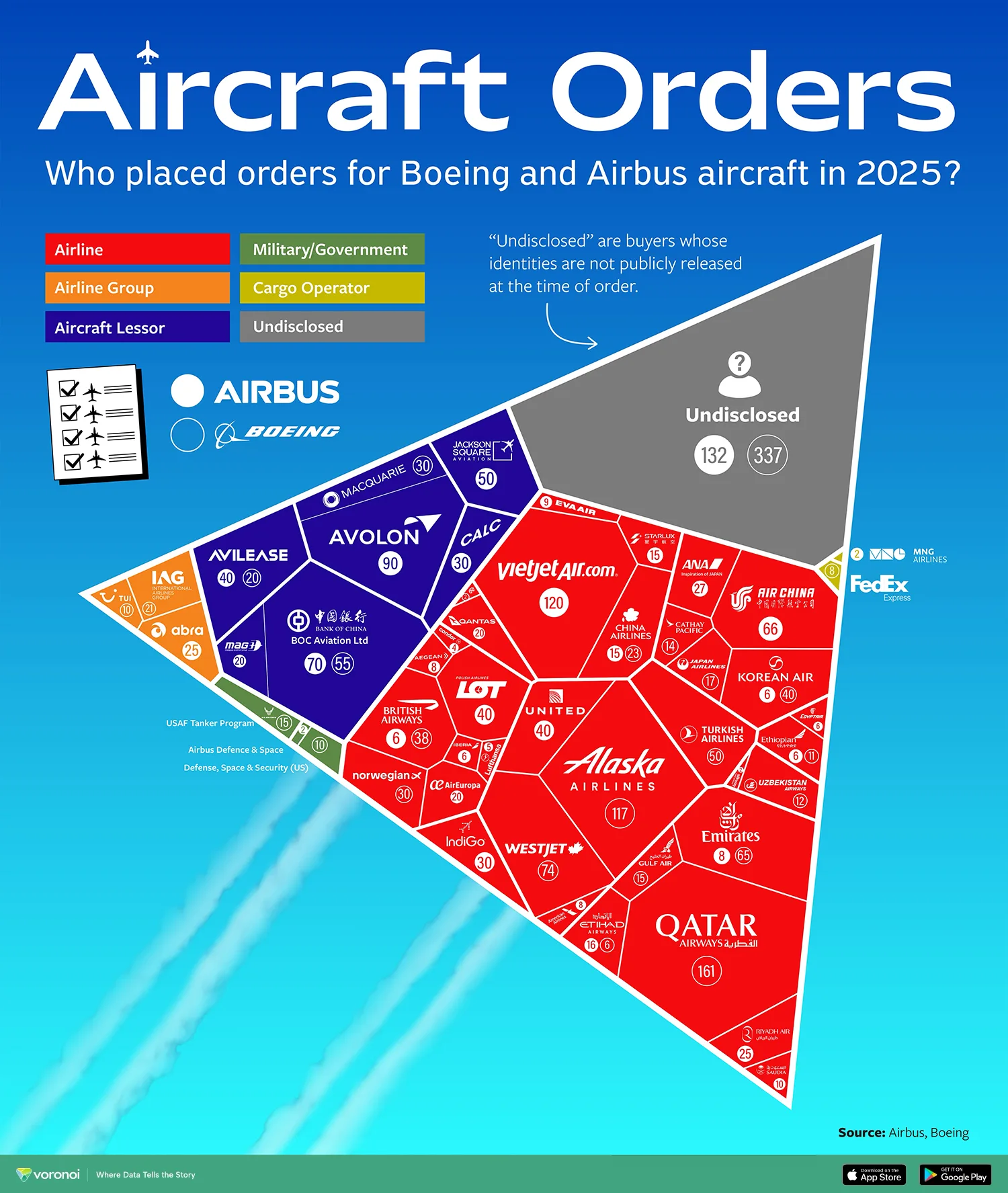

Visualized: The World’s Aircraft Orders in One Chart

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways

- In 2025, Airbus and Boeing received orders for a combined 2,175 aircraft.

- Nearly 1 in 5 aircraft orders in 2025 came from just three buyers: Qatar Airways, VietJet, and Alaska Airlines.

- Aircraft lessors made up a significant portion of orders, surpassing even airline groups and military programs.

Who’s buying the most aircraft in the world? Aircraft manufacturers Boeing and Airbus released their 2025 order books, highlighting which airlines, lessors, and governments placed orders for commercial planes. The visual above, created by Julie Peasley, breaks down all major buyers of Airbus and Boeing aircraft during the year. The full datasets are available directly from Boeing and Airbus.

The graphic also shows whether the customer ordered from Boeing, Airbus, or both, and uses color coding to indicate buyer type, ranging from airlines and airline groups to aircraft lessors and cargo operators.

Here’s the full breakdown of aircraft orders by entity in 2025:

| Buyer | Category | Quantity Airbus | Quantity Boeing | Total |

|---|---|---|---|---|

| Abra Group | Airline Group | 25 | 25 | |

| Aegean Airlines | Airline | 8 | 8 | |

| Air China | Airline | 66 | 66 | |

| Air Europa Lineas Aereas | Airline | 20 | 20 | |

| Air New Zealand | Airline | 2 | 2 | |

| Airbus Defence and Space | Military/Gov’t | 2 | 2 | |

| Alaska Airlines | Airline | 122 | 122 | |

| All Nippon Airways | Airline | 27 | 27 | |

| American Airlines | Airline | 8 | 8 | |

| AviLease | Aircraft Lessor | 40 | 20 | 60 |

| Avolon | Aircraft Lessor | 90 | 90 | |

| BOC Aviation Ltd | Aircraft Lessor | 70 | 55 | 125 |

| British Airways | Airline | 6 | 38 | 44 |

| Cathay Pacific Airways | Airline | 14 | 14 | |

| China Aircraft Leasing Group | Aircraft Lessor | 30 | 30 | |

| China Airlines | Airline | 15 | 23 | 38 |

| Condor | Airline | 4 | 4 | |

| Defense, Space & Security (US) | Military/Gov’t | 10 | 10 | |

| Egyptair | Airline | 6 | 6 | |

| Emirates | Airline | 8 | 65 | 73 |

| Ethiopian Airlines | Airline | 6 | 20 | 26 |

| Etihad | Airline | 16 | 6 | 22 |

| Eva Air | Airline | 9 | 9 | |

| FedEx Express | Cargo | 8 | 8 | |

| Gulf Air | Airline | 15 | 15 | |

| International Airlines Group (IAG) | Airline Group | 21 | 21 | |

| Iberia | Airline | 6 | 6 | |

| Indigo | Airline | 30 | 30 | |

| Jackson Square Aviation | Aircraft Lessor | 50 | 50 | |

| Japan Airlines | Airline | 17 | 17 | |

| Korean Air | Airline | 6 | 40 | 46 |

| LOT Polish | Airline | 40 | 40 | |

| Lufthansa | Airline | 5 | 5 | |

| Mab Leasing | Aircraft Lessor | 20 | 20 | |

| Macquarie AirFinance Ltd | Aircraft Lessor | 30 | 30 | |

| Mng Airlines Cargo | Cargo | 2 | 2 | |

| Norwegian Air | Airline | 30 | 30 | |

| Qantas Airways | Airline | 20 | 20 | |

| Qatar Airways | Airline | 161 | 161 | |

| Riyadh Air | Airline | 25 | 25 | |

| Saudia | Airline | 10 | 10 | |

| Silk Way West Airlines | Airline | 2 | 2 | |

| Starlux Airlines | Airline | 15 | 15 | |

| TUI Travel PLC | Airline Group | 10 | 10 | |

| Turkish Airlines | Airline | 50 | 50 | |

| United Airlines | Airline | 40 | 40 | |

| USAF Tanker Program | Military/Gov’t | 15 | 15 | |

| Uzbekistan Airways | Airline | 22 | 22 | |

| Vietjet Air | Airline | 120 | 120 | |

| WestJet | Airline | 74 | 74 | |

| Unidentified Customer | Undisclosed | 132 | 328 | 460 |

While Qatar Airways led all named buyers with 161 aircraft orders, the biggest segment overall is “Undisclosed” buyers, accounting for 469 aircraft combined across both manufacturers.

Aircraft buyers are often listed as “undisclosed” to protect strategic plans, pending regulatory approvals, or leasing arrangements where the final airline hasn’t been determined yet. Manufacturers still record these orders to reflect real demand while honoring customer confidentiality.

Aircraft lessors like Avolon, BOC Aviation, and Macquarie also played a major role in demand.

Who’s Driving Demand?

Looking at the categories of buyers, airlines dominated overall, placing more than 1,200 orders. However, aircraft lessors also made a substantial impact, accounting for over 400 aircraft. These entities purchase planes to lease them to airlines, serving as financial intermediaries in the aviation ecosystem.

Military and government buyers made a small but notable appearance. The U.S. Air Force and defense departments from Europe and the U.S. made targeted purchases, reflecting ongoing needs for refueling and defense infrastructure.

Air Travel Recovery Fuels Orders

With global air travel surpassing 2019 levels in many regions, carriers are investing heavily in new, more fuel-efficient aircraft. In Asia, airlines like VietJet, Korean Air, and China Airlines are expanding their fleets rapidly. Meanwhile, American carriers such as Alaska Airlines and WestJet are modernizing for both domestic and transborder routes.

As travel rebounds, competition between Boeing and Airbus will remain fierce. However, the surge in demand suggests a strong outlook for the industry as a whole.

Learn More on the Voronoi App

Explore how Boeing’s business spans beyond commercial jets in Boeing’s Business Is Much More Than Just Commercial Planes.