Visualized: What Are Stablecoins Backed By?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways

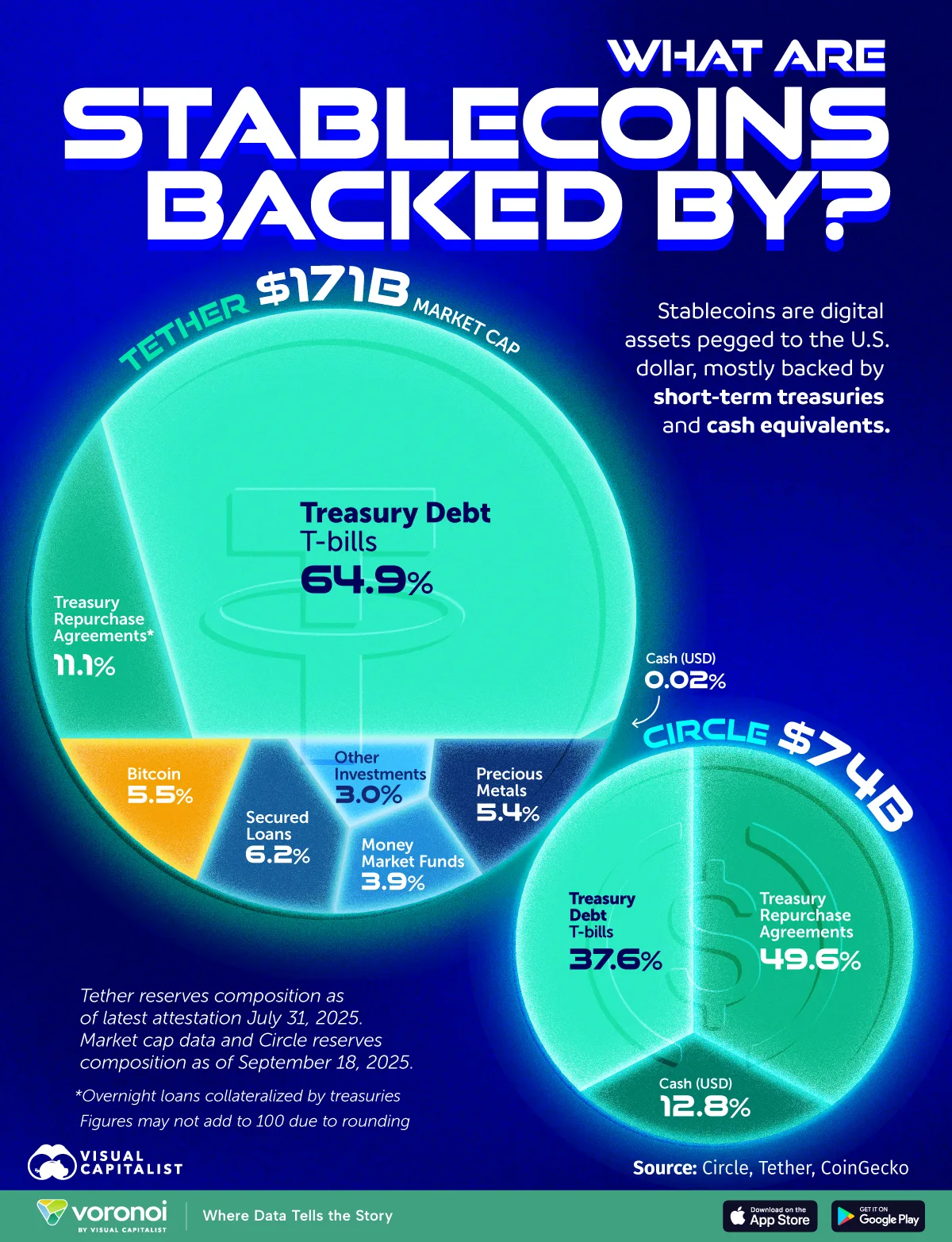

- Tether, with a market cap of $171 billion, is primarily backed by U.S. Treasury T-bills (64.9%), followed by Treasury repurchase agreements (11.1%) and other assets like bitcoin (5.5%) and precious metals (5.4%).

- Circle (USDC), with a market cap of $74 billion, has a more concentrated backing in T-bills (37.6%) and repo agreements (49.6%), with 12.8% in cash reserves.

Stablecoins have become a central pillar of the crypto economy, offering traders and investors a digital asset pegged to the stability of the U.S. dollar. But behind their promise of stability lies an important question: what are they backed by?

This visualization breaks down the asset reserves of the two largest stablecoins, Tether (USDT) and Circle (USDC), which together represent over $240 billion in market value.

The Assets Backing Stablecoins Tether and Circle

The data table below breaks down the assets backing Tether and Circle, and comes directly from Tether’s latest reserve attestation as of July 2025 and Circle’s transparency page. Market cap data comes from CoinGecko and is as of September 18, 2025.

| Asset | Tether ($171B market cap) | Circle ($74B market cap) |

|---|---|---|

| Treasury Debt (T-bills) | 64.9% | 37.6% |

| Treasury Repurchase Agreements (Overnight loans collateralized by Treasurys) | 11.1% | 49.6% |

| Cash (USD) | 0.02% | 12.8% |

| Other Investments | 3.0% | |

| Bitcoin | 5.5% | |

| Precious Metals | 5.4% | |

| Money Market Funds | 3.9% | |

| Secured Loans | 6.2% |

Tether, the dominant stablecoin in the cryptocurrency ecosystem, holds nearly two-thirds of its $171 billion reserves in short-term U.S. Treasury bills. These highly liquid assets provide security and quick convertibility.

An additional 11% is in overnight Treasury repurchase agreements, with the remainder spread across bitcoin, precious metals, cash, and other investments.

Circle is built on a simpler balance sheet. Nearly 88% of reserves sit in either Treasury securities (37.6%) or repo agreements (49.6%) in the Circle Reserve Fund managed by BlackRock, while cash deposits make up the rest at 12.8%.

Unlike Tether, Circle avoids allocating reserves to riskier assets like bitcoin, metals, or unspecified investments, giving it a cleaner—but less diversified—profile.

Comparing Stablecoins Tether and Circle’s Reserves

Both companies rely heavily on U.S. government-backed securities, but their strategies differ.

Tether’s inclusion of bitcoin and metals reflects a willingness to diversify, potentially increasing returns but also introducing volatility.

Circle’s concentration in Treasuries and cash emphasizes safety and simplicity. For investors and regulators, these differences raise questions about transparency, risk, and how resilient each stablecoin might be under stress.

Learn More on the Voronoi App

To learn more about where stablecoins stand in the overall crypto ecosystem, check out this graphic breaking down the top 20 cryptocurrencies by market cap on Voronoi, the new app from Visual Capitalist.