“Some conventional pest control products aren’t working as well anymore or are being regulated out of existence,” says Chris Taylor, partner at agrifoodtech advisory firm The Mixing Bowl and author of the frequently cited Crop BioControl Landscape market map.

Biopesticides, such as those outlined on Taylor’s map, are one answer to this problem.

After years of farmer skepticism and efficacy challenges, biocontrol products are finally gaining some market share from their traditional, chemical-based counterparts. According to the 2025 CropLife Biologicals Survey, 29% of surveyed retailers carry biopesticides. Although the survey focuses mostly on US row crop retailers, this is strong indication of growing interest in this class of products.

The big names in crop inputs are all leading the charge, including Corteva, BASF, Bayer, and Syngenta, according to CropLife’s survey. In many cases, those firms have acquired innovative startups to create or build on their internal biologicals capabilities and science.

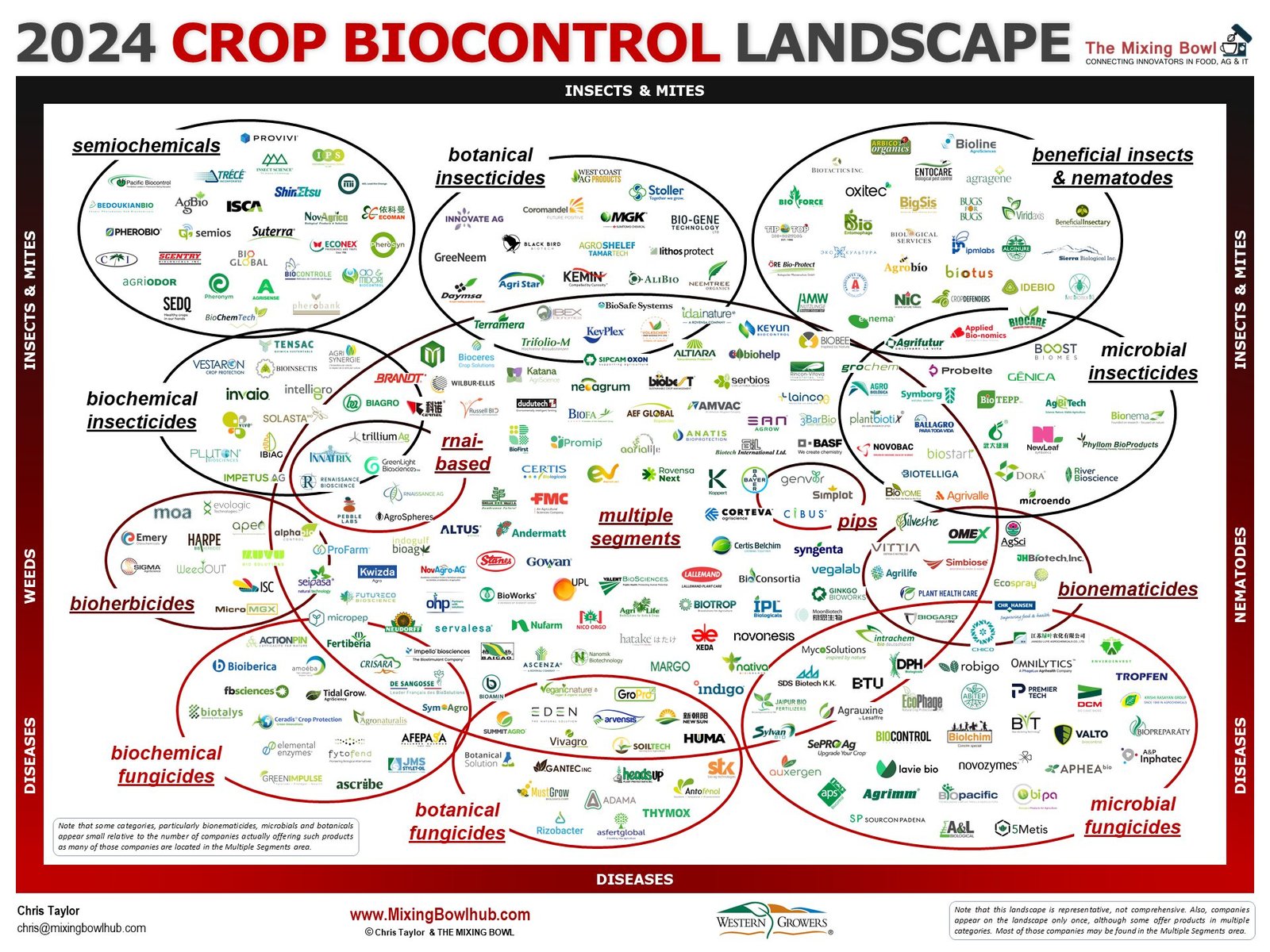

The Mixing Bowl’s 2024 BioControl Landscape includes 300 companies providing biological solutions for insect, mite, disease, weed, and nematode control in crops. This is not an exhaustive list, as there are many other companies active in the field, but it is an important representation of the sector’s diversification and of its most relevant technologies.

And while funding to these companies has been volatile over the past 10 years, skewed by large deals rather than following a clear trend, continued investment in early stage biocontrol deals is a notable indication of the sector’s promise and recent success, according to AgFunder data matched to The Mixing Bowl’s market map of companies.

What are biocontrol inputs?

Biocontrol inputs leverage naturally derived substances and microorganisms to control pests and disease in crops.

Farmer demand for biological inputs—which can complement both conventional and regenerative agriculture—has grown due partly to an increased awareness of chemical inputs’ impact on the land. Related to this, pests and weeds have become more resistant to some traditional products, while more stringent regulation is, as Taylor mentioned, phasing products out. Consumers, meanwhile, demand “cleaner” food at an increasing rate.

DunhamTrimmer, widely regarded as the authority on all things bio-intelligence, projects that the global biocontrol market will exceed $15 billion by 2029. “This is an amazing achievement for an industry that didn’t reach $1 billion in global sales until 2010,” the firm notes.

Biological enhancement products—also known as biostimulants—have typically taken the lion’s share of biological product sales. According to CropLife’s March survey, however, biocontrol products now account for 17% of biological sales amongst survey respondents, with surveyed US retailers reporting a revenue increase of 7% in biopesticide sales for 2024.

That regulations “are more structured on the biocontrol side of the biologicals market,” is also helping feed the growth and improve trust in the products, says Taylor.

”Consolidation in the market is taking place, large companies are doing acquisitions and have started to apply their muscle in the sector. Many of them didn’t have a presence in biologicals before, so they have been trying to build that up. They’ve certainly been marketing it heavily over the last couple of years, and if you go to their websites, biologicals are now right on their front pages.”

Even with this consolidation, there’s no shortage of startups out there for investors to back.

The biocontrol side in particular still has abundant opportunities for the development of new ingredients and solutions, and the range of problems startups are trying to solve is always expanding. In comparison, the biostimulants market relies on a relatively limited number of ingredients, and new products are mostly pursuing incremental gains.

In addition to acquisitions, there are also plenty of partnerships taking place in the biocontrol sphere, and often companies rely on complex levels of licensing and distribution agreements.

As Taylor puts it: “Big companies are trying to acquire innovation in order to expand their biological footprint, while for the startups it is vital to expand distribution and reach. For many new companies it would be really hard to try and push into the market without a partnership with an established distribution channel.”

A decade in agricultural biocontrols

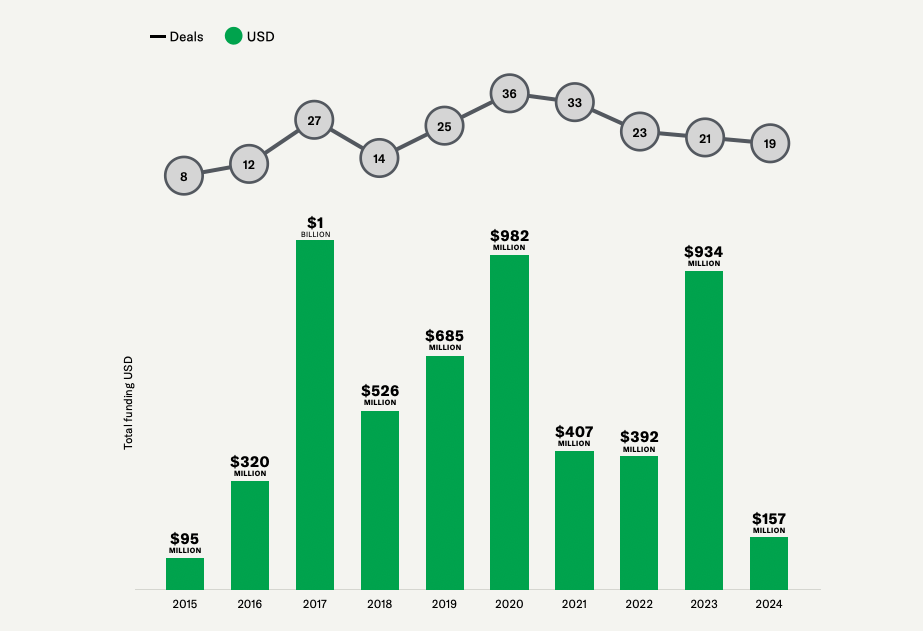

10-year investment in crop biocontrol

Over the past 12 years, since AgFunder records began, biocontrol companies in the Mixing Bowl landscape have raised a total of $5.7 billion.

Of the 300 companies listed in the Crop Biocontrol Landscape, 66 presented funding information for a total of 244 rounds.

While deal activity has increased along with general venture capital market trends, reaching a peak of 36 and 33 deals closed in 2020 and 2021, respectively, it has since plateaued to around 20.

In dollar investment terms, the last five years have not followed an observable trend. While volumes tanked in 2021 and 2022, two large deals—$391 million for Biobest (over multiple rounds) and $270 million for Indigo Ag—pushed them up again to nearly $1 billion in 2023.

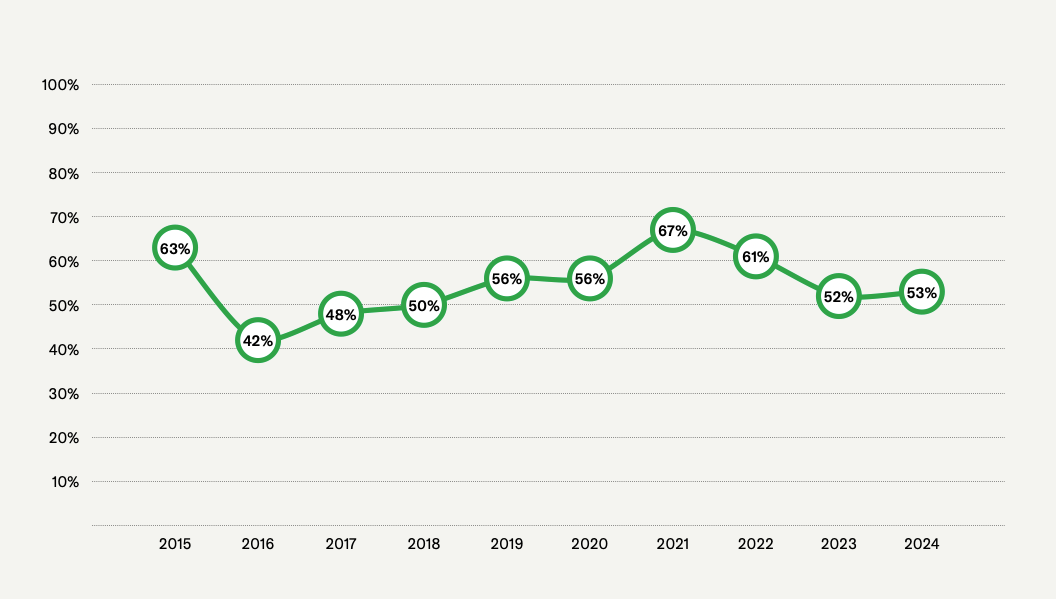

Percentage of deal count going into early stage deals (seed and Series A)

Despite an 83% decline in funding year-over-year to 2024, which is in line with investment trends for agtech in general, the number of deals closed remained almost flat, with more than half at seed or Series A stage.

On the other hand, since 2018, early stage investments have been attracting at least 50% of the deal count, with a peak at 67% in 2021. This early stage investor resilience is a notable indication of the sector’s promise.

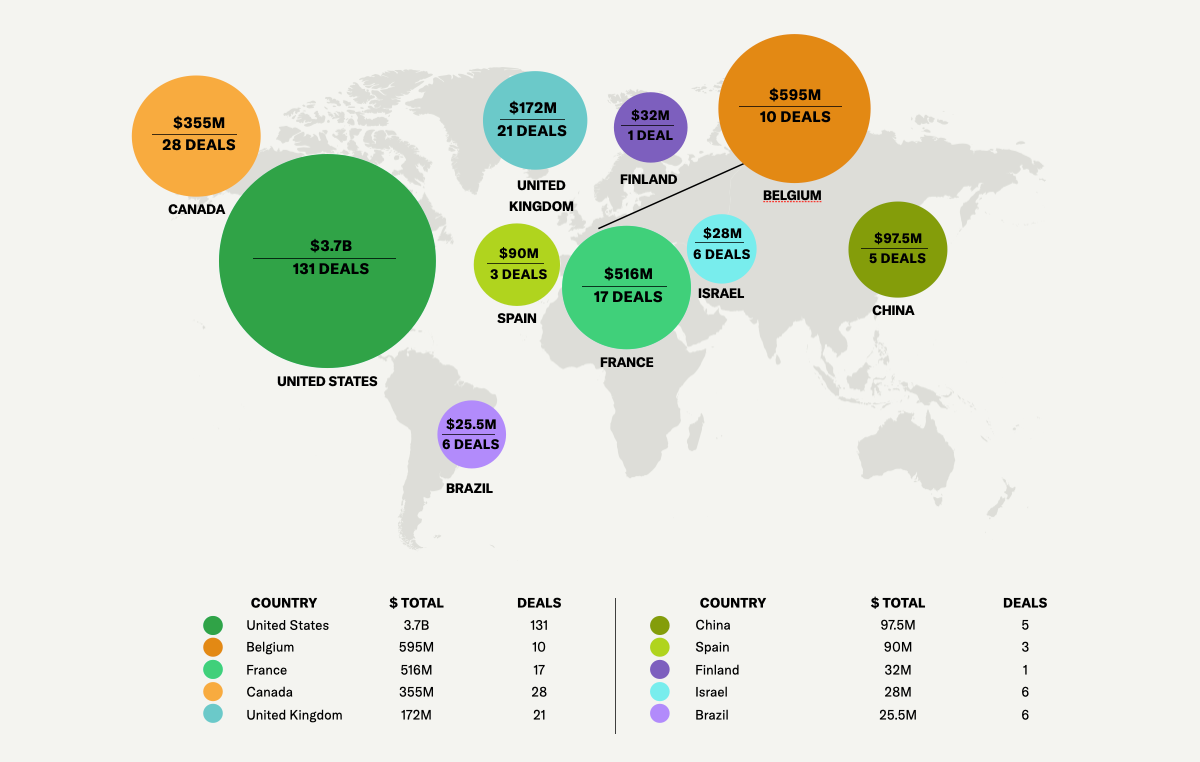

Investment by geography

The US is the leading startup ecosystem, raising $3.7 billion across 131 deals since 2012. Belgium followed with 10 deals worth $595 million concentrated in three companies (Biobest, Aphea.Bio, and Biotalys), and France with $516 million across 17 deals.

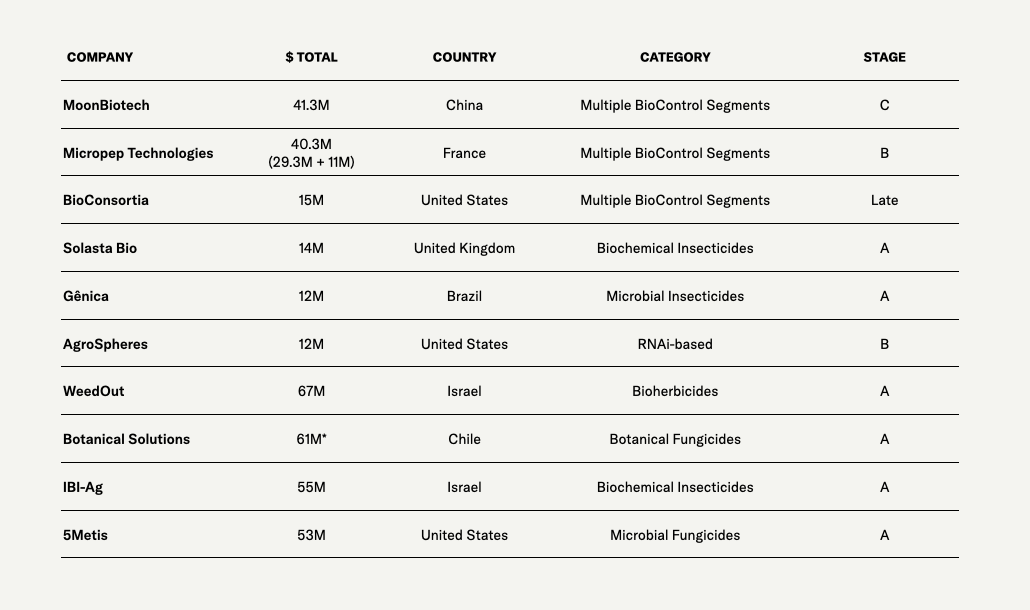

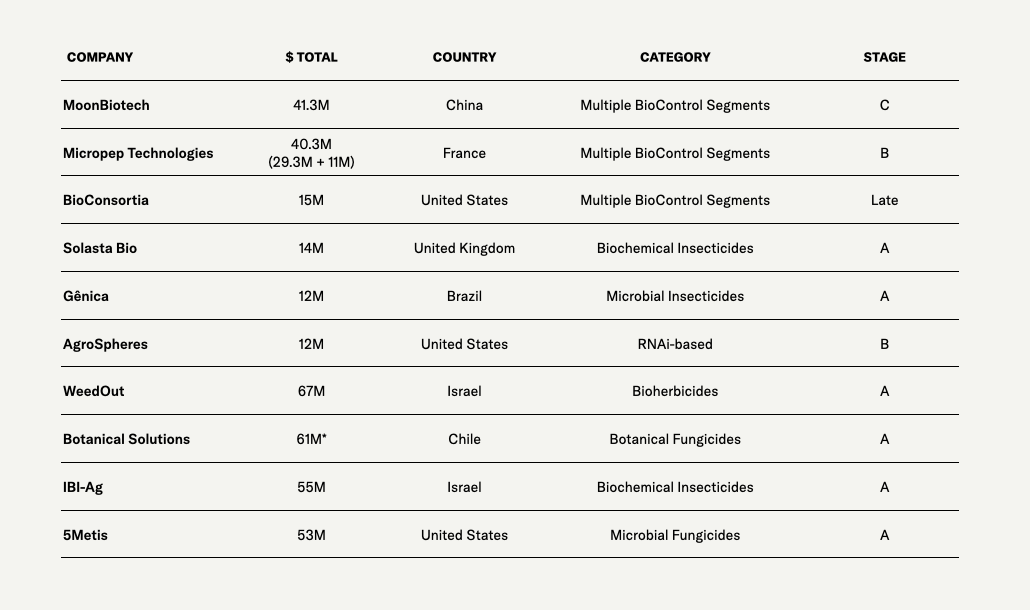

Top 5 deals of 2024

Top 10 best-funded startups (since 2012)

Top 20 Investors (since 2012)

Mapping the crop biocontrol landscape

This map segments the market by type of pest addressed. The upper segment focuses on solutions for insects and mites, the lower on crop diseases, and the central left and right areas cater to weed and nematode control.

Beyond pest type, the market is further categorized into twelve product segments based on their technology, with about 40% of these biocontrol companies operating in multiple segments.

The Mixing Bowl will be presenting its new Crop Biostimulants Market Landscape at The 2025 Salinas Biological Summit, hosted at the Yolo County Fairgrounds in Woodland, California, on June 24-25.

This article was produced in collaboration with The Mixing Bowl and Western Growers.

The post With nearly $6bn raised since 2012, biological control funding is volatile yet buoyed by resilient early-stage activity appeared first on AgFunderNews.