On December 16, 2025, DHL Express confirmed a new fuel agreement. The company signed a binding offtake contract with the renewable fuels producer Neste. Under this deal, DHL will receive 50 million liters of Sustainable Aviation Fuel (SAF) for deliveries in 2026.

The fuel will be used in DHL’s air cargo flights to help reduce carbon emissions. This deal is one of the first under the tightened ReFuelEU Aviation rules, which increase SAF requirements at European airports starting in 2026.

DHL moved early to lock in supply. The company expects SAF prices to rise once the new rules begin in January. Securing supply now helps DHL manage future costs and ensure fuel availability as demand grows.

ReFuelEU Aviation: Redrawing the Fuel Mix

The ReFuelEU Aviation regulation is part of the European Union’s plan to cut aviation emissions. The regulation sets minimum shares of SAF that fuel suppliers must deliver at EU airports. These required shares increase each year. The goal is to reduce greenhouse gas emissions from flights over time.

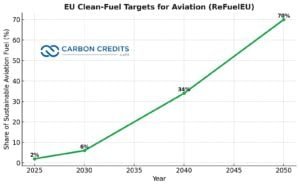

In 2025, fuel suppliers must blend about 2% SAF into jet fuel at EU airports. This percentage increases to 6% by 2030 under the regulation. Rules will continue rising toward 70% by 2050. Aircraft operators that fail to meet these requirements may face penalties.

These mandates follow global climate goals, including the aviation industry’s pledge to reach net-zero carbon emissions by 2050. SAF is central to these plans because it can cut lifecycle CO₂ emissions compared with traditional jet fuel.

However, SAF remains more costly and less widely produced than conventional jet fuel. That has raised concerns about supply, prices, and the ability of airlines and cargo carriers to meet future mandates.

The EU aims to help address this by revealing a $108 billion investment plan to help decarbonize the sector. The funding will help ramp up the production and use of cleaner fuels like SAF for aviation and maritime.

Why DHL’s SAF Contract Matters? Net Zero Goals and Emissions Reduction Progress

DHL’s contract with Neste covers 50 million liters of SAF for delivery in 2026. The fuel will help power part of DHL’s air cargo flights in Europe. Neste will supply SAF made from renewable waste and residue materials. These feedstocks reduce lifecycle emissions compared with fossil fuels.

This agreement puts DHL among the early adopters of SAF under the new EU rule changes. It shows the growing role of long-term fuel contracts in securing carbon-reducing fuels. These contracts also help SAF producers plan and finance future production capacity.

Deals like DHL’s offer two key benefits:

- Price certainty: Buyers secure fuel at a set price before markets tighten and costs rise.

- Supply assurance: Long-term contracts guarantee volumes when the total SAF supply is limited.

For logistic operators like DHL, these benefits help manage operational costs and regulatory compliance. Beyond these is the environmental benefit for the logistics company.

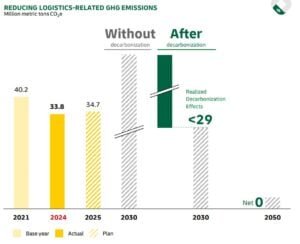

DHL Group has committed to reaching net-zero greenhouse gas emissions by 2050 across all its logistics operations. This target aligns with global climate goals and covers air, road, and supply chain activities.

To stay on track, DHL has set clear interim goals and actions:

- Cut total emissions to below 29 million metric tons of CO₂e by 2030, down from about 40 million metric tons.

- Increase the use of sustainable fuels, including SAF, across air freight operations.

- Source over 30 percent of transport fuels from sustainable alternatives by 2030.

- Electrify more than 66% of last-mile delivery vehicles used for parcel delivery.

- Improve fuel efficiency through better flight planning, routing, and load optimization.

- Work with fuel suppliers and partners to secure long-term SAF supply contracts.

DHL has already begun using SAF on selected air routes and has signed multiple long-term fuel agreements, including this recent one with Neste. These steps help reduce emissions now while preparing for tighter climate rules in the coming years.

Inside the Global SAF Supply Crunch

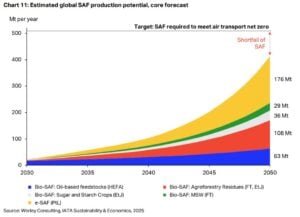

The SAF market is still small compared with overall aviation fuel demand. Current production is limited but growing. In 2023, global SAF output climbed to around 600 million liters—about double the 300 million liters produced in 2022.

Total SAF in 2024 reached about 1.3 billion liters (nearly 1 million tonnes) worldwide. Even with this growth, SAF accounted for only about 0.3% of global jet fuel use in 2024.

Despite these gains, production remains far below what is needed to meet future emissions targets. According to industry forecasts, global SAF output could grow sixteen-fold by 2030 to roughly 6.1–8.2 billion gallons per year (about 23–31 billion liters). Other reports estimate SAF production near 10 billion liters by 2030.

Even with this expansion, SAF would still represent a small share of total aviation fuel demand unless growth accelerates well beyond these projections.

In addition to volume limits, SAF supply faces other challenges:

- High costs: SAF currently costs two to five times more than conventional jet fuel in many markets.

- Feedstock limits: SAF feedstocks, such as used cooking oil and agricultural residues, are in demand from other industries, which limits scaling potential.

- Infrastructure gaps: Distribution and blending facilities are still being built in many regions.

Because of these limits, SAF supply is expected to stay tight relative to demand through at least the late 2020s.

Growth Forecasts Meet Real-World Constraints

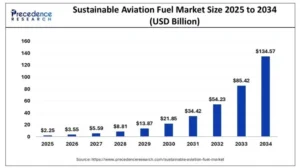

Despite challenges, the SAF market is forecast to grow strongly as policy mandates and corporate commitments expand.

Market analysts project the global SAF market value at around US$2.06–2.08 billion in 2025. By 2030, the industry could reach US$25–26 billion. This implies a compound annual growth rate (CAGR) above 60 percent through the late 2020s.

In terms of production volume, analysts expect large increases, with forecasts ranging from several billion gallons per year by 2030. The expansion reflects rising demand due to regulatory pressure, corporate sustainability goals, and growing aviation activity.

By 2050, much larger SAF volumes may be necessary. One global industry assessment suggests the aviation sector may need around 500 million tonnes of SAF by 2050 to achieve net-zero emissions.

Currently, global SAF production is only about 2 million tonnes and represents less than 1 percent of total aviation fuel consumption. Bridging the gap will require dramatic increases in production capacity and feedstock supply over the next 25 years.

What This Signals for Aviation’s Low-Carbon Shift

DHL’s 50 million-liter SAF agreement with Neste highlights several key trends in aviation fuel markets:

- Early action: Fuel buyers are signing long-term contracts ahead of tighter regulations.

- Supply competition: With limited SAF output, early offtake deals secure fuel before wider market tightening.

- Growing corporate role: Logistics firms and airlines are increasingly active buyers of SAF.

- Market scale-up: SAF volumes are rising, but still far short of future demand needs.

DHL’s contract is not an isolated case. Large buyers around the world are seeking stable SAF supply to meet regulatory targets and sustainability goals. As SAF production capacity expands slowly, long-term agreements and supportive policies will be vital to growing the market.

The company’s early move shows how policy changes are shaping business decisions today rather than in the distant future. In this environment, SAF is no longer a niche fuel. It is becoming a necessary part of the future aviation fuel supply.

The post DHL Signs Major SAF Deal with Neste Ahead of New EU Rules appeared first on Carbon Credits.