The long-anticipated merger between Teck Resources (TSX: TECK.A/TECK.B, NYSE: TECK) and Anglo American (LON: AAL) has taken a decisive step forward. The Government of Canada has approved the transaction under the Investment Canada Act, clearing one of the most important regulatory hurdles for the creation of Anglo Teck, a new global mining heavyweight headquartered in Vancouver.

This approval follows the merger announcement made in September 2025 and signals strong federal support for building a Canadian-based leader in critical minerals. With shareholders from both companies also voting in favor earlier this month, the deal now moves closer to completion, pending remaining regulatory clearances in other jurisdictions.

A Strategic Bet on Canada’s Critical Minerals Future

At its core, the merger is about scale, resilience, and long-term value. Anglo American and Teck have positioned Anglo Teck as a global supplier of responsibly produced critical minerals, with Canada as its operational and strategic anchor.

Under binding commitments agreed with Ottawa, Anglo Teck will invest at least C$4.5 billion in Canada over the next five years. These funds will support major projects across British Columbia, including:

-

Extending the life of the Highland Valley Copper mine

-

Expanding critical minerals processing capacity at Trail Operations

-

Advancing development at the Galore Creek and Schaft Creek copper projects

Over a longer horizon, these near-term investments unlock a minimum C$10 billion spending commitment over 15 years, reinforcing Canada’s position in global copper and critical minerals supply chains.

Importantly, the government approval reflects confidence that the merger delivers a “net benefit” to Canada. That benefit includes capital inflows, employment stability, indigenous engagement, and stronger integration into clean energy supply chains.

- READ DETAILS: Anglo American and Teck Create a $50B Copper Giant to Fuel the Clean Energy Revolution

Leadership Signals Confidence and Continuity

Anglo American CEO Duncan Wanblad framed the approval as more than a regulatory milestone. He described it as a foundation for lasting economic and social value across Canada’s mining ecosystem.

He emphasized that Anglo Teck will preserve the legacy of both companies while expanding their global footprint. Vancouver will host the company’s global headquarters, while South Africa and other operating regions will continue to receive sustained investment.

This continuity matters. It reassures governments, workers, and Indigenous partners that the merger is not about asset stripping, but about long-term growth built on responsible mining.

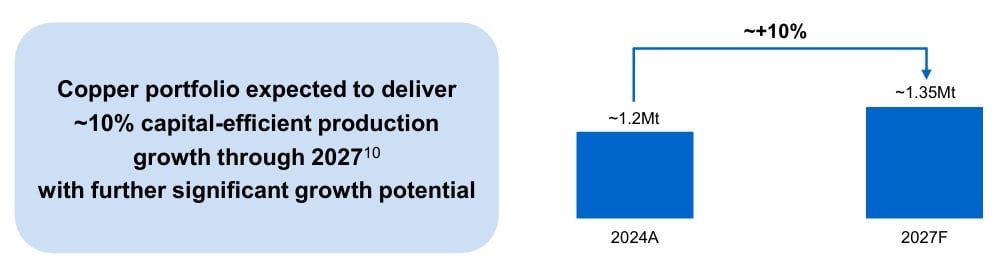

What the Merger Means for Copper Production

Teck expects to produce 415,000 to 465,000 tonnes of copper in 2025, largely from Canadian operations. The company’s flagship asset, Highland Valley Copper, remains the country’s largest copper mine and a cornerstone of this outlook.

Highland Valley processes around 50 million tonnes of ore annually, with copper output fluctuating based on ore grades. In 2025, the mine is expected to produce roughly 120,000 to 130,000 tonnes of copper.

However, Teck’s short-term production outlook remains under pressure. Ramp-up challenges at the Quebrada Blanca project in Chile have weighed on guidance. While this impacts near-term volumes, the merger creates room for operational improvements and efficiency gains over time.

Crucially, Anglo Teck plans to invest C$2.1 to C$2.4 billion to extend Highland Valley’s life to 2046. Post-extension, annual output could rise to 132,000–137,000 tonnes, providing long-term stability in Canadian copper supply.

Export Markets Remain the Primary Destination

Canada’s copper production largely serves international markets, and the merger will not dramatically change that dynamic.

Most copper from Teck’s Canadian mines ships as concentrate through the Port of Vancouver, primarily to Japan and China under long-term supply agreements. These exports align with rising global demand, especially from electrification and energy transition sectors.

Investments at Galore Creek and Schaft Creek, backed by up to C$750 million, could further support export growth over time. Together, these projects strengthen Canada’s role as a reliable upstream supplier, even if most refining happens abroad.

Processing Gains

Canada still lacks large-scale domestic copper smelting capacity. As a result, most of Teck’s copper output feeds global markets rather than domestic manufacturing.

That said, Anglo Teck’s planned C$850 million investment at Trail Operations could improve domestic processing capacity for certain critical minerals. While this will not transform Canada into a major copper refining hub, it does support value-added processing and supply chain resilience.

Meanwhile, commitments around employment, headquarters location, and community engagement help maintain operational stability without disrupting existing trade flows.

A Strong Long-Term Case for Investors

From an investor perspective, the Anglo Teck merger offers exposure to one of the most structurally tight commodity markets in the world.

The International Copper Study Group reports that the global supply of refined copper grew by just 1% in 2024. Meanwhile, mine supply went up by less than 2%. This shows how slowly the new supply is growing.

At the same time, demand is accelerating. IEA reported that refined copper consumption reached nearly 27 million tonnes in 2024 and could climb to 33 million tonnes by 2035, with projections pointing to 37 million tonnes by 2050.

China alone accounted for nearly 60% of global demand last year, while the U.S. and Germany followed as major consumers.

These trends set the stage for volatility. Inventories on the London Metal Exchange sit near multi-year lows, meaning even small disruptions can trigger sharp price moves. Analysts warn that conditions could tighten further by 2026.

J.P. Morgan expects a 330,000-ton refined copper deficit in 2026 and forecasts copper prices rising to around $12,500 per tonne in the second quarter of that year.

Balancing Growth with Risk

Still, risks remain. Interest rate shifts, geopolitical tensions, and supply chain disruptions could weigh on sentiment. However, Anglo Teck’s diversified asset base, long-life mines, and focus on responsible production help soften these risks.

Equally important, the company aligns closely with Canada’s national critical minerals strategy. That alignment opens doors to policy support, tax incentives, and government-backed financing, further reducing long-term execution risk.

To summarize, the Anglo Teck merger is more than a corporate transaction. It reflects a strategic bet on copper, decarbonization, and Canada’s role in the global energy transition.

The post Canada Approves Anglo–Teck Merger to Power the Clean Energy Copper Supply Chain appeared first on Carbon Credits.