Global Solar Additions to Fall for First Time in 2026

For many years now we have seen consecutively larger increases in the solar additions but it looks like this is coming to an end (halt?).

Introduction to BNEF’s Solar Forecast

BloombergNEF (BNEF) has long been one of the most trusted names in clean energy research, tracking how renewables reshape the global energy system and when their analysts speak, investors, policymakers, and sustainability leaders usually lean in.

So when BNEF recently projected that global solar additions will decline in 2026 — the first drop in years — it raised both eyebrows and questions. With solar energy being the poster child of the renewable revolution, growing at an ever increasing pace few industries can match with desert megaprojects in China to suburban rooftops in Sydney, helping cities and countries alike cut emissions.

Understanding the Predicted Decline in Solar Additions by 2026

According to BNEF’s forecast, solar installations are expected to grow through 2025 before flattening and then slipping in 2026. That pause comes after record years — more than 400 gigawatts of capacity were added in 2024 alone, driven by falling costs and soaring demand for clean electricity. By 2026, the figure could dip for the first time in over a decade.

Several forces are converging here. Some regions are reaching temporary market saturation, while others face grid constraints that make it hard to connect new solar farms. The world’s supply of cheap panels — mostly from Asia — is outpacing local installation capacity in places like Europe and the U.S. And as easy-to-develop sites are used up, new projects often come with higher logistical and permitting challenges.

Economic and Market Factors Influencing Solar Installations

Economic headwinds are playing a major role. When interest rates rise, as they have in recent years, financing large-scale solar projects becomes less attractive. A one- or two-percentage-point change might not sound dramatic, but for billion-dollar solar farms, it can be the difference between “go” and “wait.”

Government incentives have also shaped the rhythm of solar growth. The U.S. Inflation Reduction Act unleashed a wave of clean energy investment, but similar support in other regions has lagged. In markets where subsidies are reduced or expire, solar adoption often dips before stabilizing again. Add to that the fluctuating cost of raw materials — silicon, silver, aluminum — and a fragile supply chain still recovering from pandemic disruptions, and you’ve got a recipe for caution.

Technological Advancements and Their Impact

On the brighter side, technology continues to advance. Solar panel efficiencies, which hovered around 15% two decades ago, now regularly exceed 22%, and new materials like perovskites promise to push that even higher. Dual-sided panels, solar tiles, and floating solar farms are making the technology more adaptable than ever.

Still, innovation can sometimes slow adoption in the short term. When developers know that next year’s panels could be cheaper and more efficient, some hold off on projects to wait for better returns. It’s a familiar cycle in tech: progress that briefly pauses progress. Yet over the long haul, these innovations tend to reignite growth — and with a sharper upward curve.

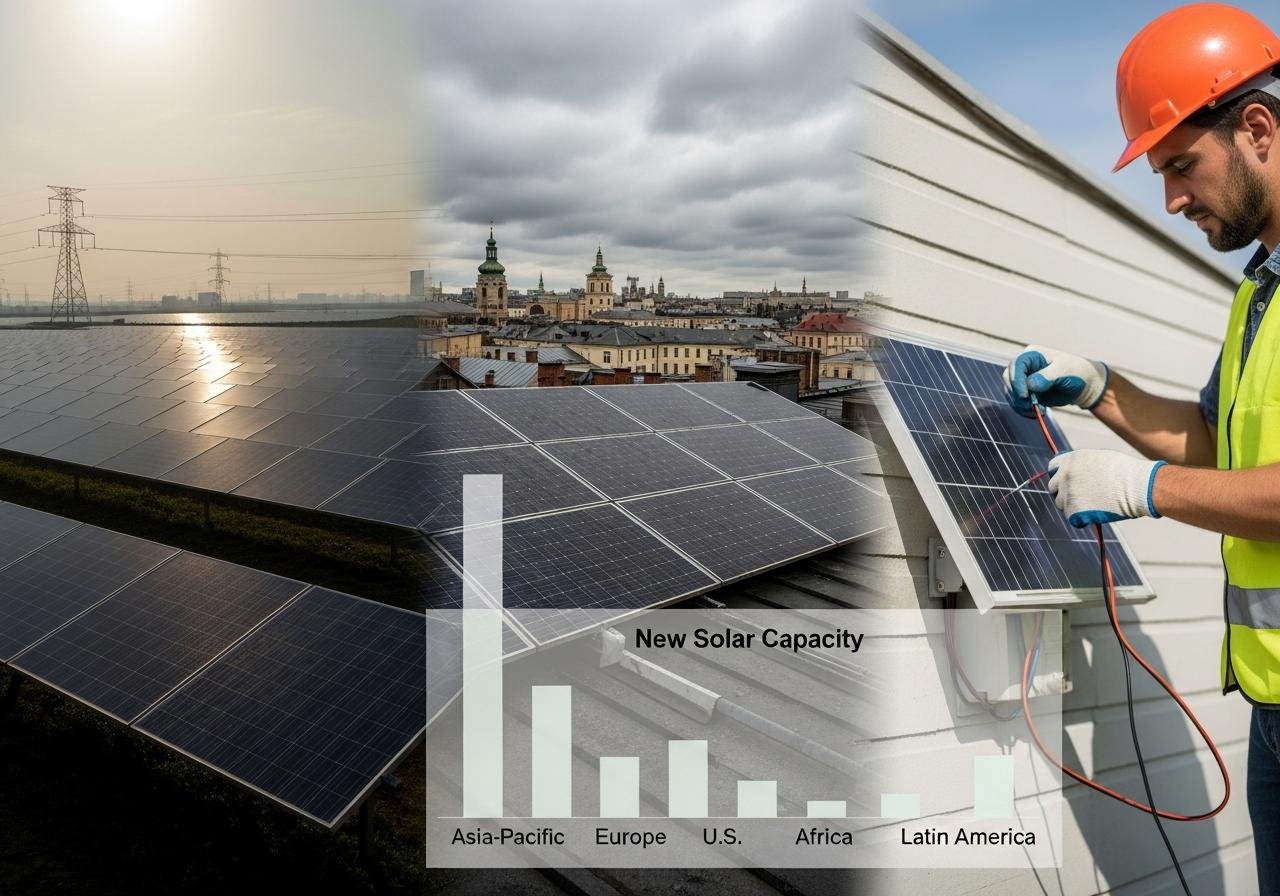

Regional Variations in Solar Energy Adoption

Solar doesn’t grow evenly around the world. In China, installation rates have surged thanks to aggressive manufacturing and supportive policy, but even there, grid congestion and land-use limits are starting to pinch. Europe’s growth is solid but constrained by permitting delays and grid bottlenecks. The U.S., meanwhile, is seeing a tug-of-war between federal incentives and local challenges like interconnection queues and labor shortages.

Asia-Pacific continues to dominate in new capacity, while emerging markets in Africa and Latin America are on the rise — albeit from smaller bases. Each region’s story is shaped by its policy ambitions and infrastructure readiness. The common thread is that demand remains high; it’s the ability to deliver projects efficiently that varies.

The Role of Policy and Regulation

Policy remains the quiet engine (or brake) behind solar growth. International frameworks like the Paris Agreement set ambitious targets, but local execution often determines real-world results. Faster permitting processes, grid modernization, and continued incentives can keep momentum alive through 2026 and beyond.

Recent regulatory changes — from trade policies impacting module imports to renewable portfolio standards — also influence the pace. Some experts argue that governments need to coordinate better across sectors, linking solar policy with transportation electrification and building efficiency. Solar doesn’t exist in a vacuum; it’s part of a larger clean energy puzzle.

Future Prospects and Global Implications

So what happens if solar additions truly decline in 2026? It likely won’t derail global climate goals but may highlight growing pains in a maturing industry. A brief slowdown could even help stabilize supply chains, refine grid planning, and clear regulatory backlogs — paving the way for a steadier, more connected phase of growth.

For investors, the message is to zoom out. The world’s demand for clean electricity isn’t shrinking; it’s recalibrating. Solar remains one of the most cost-effective sources of new power, and as storage technologies expand, the value of every installed panel only increases.

The long-term outlook is still exceptionally strong. By the 2030s, solar could become the largest single source of electricity generation worldwide. A single year’s dip may simply be the breath before the next sprint.

Conclusion

The BNEF forecast serves as a reminder that growth in renewable energy isn’t perfectly linear — and that’s okay. Even as numbers wobble, the direction of travel remains clear: toward cleaner, cheaper, and more sustainable power. For now, the challenge is to turn this momentary lull into an opportunity to refine policy, modernize grids, and back the next wave of innovation.

After all, the sun isn’t going anywhere. The question is how smartly and swiftly we harness it.

Frequently Asked Questions — Global Solar Additions to Fall in 2026

Frequently Asked Questions — Global Solar Additions to Fall in 2026

1. What is the main news about global solar additions?

Global solar power capacity additions are forecast to decline in 2026 for the first time ever, reversing the long-standing trend of year-on-year growth in annual solar installations. Bloomberg

2. Which organization made this forecast?

The forecast comes from BloombergNEF (BNEF) in its latest Global PV Market Outlook. Bloomberg

3. How big is the expected drop in solar additions?

According to BNEF’s outlook, total global solar capacity additions in 2026 are expected to be slightly lower than in 2025 — marking the first net decline in annual installations. Bloomberg

4. Why is this decline significant?

This would be the first annual decline since solar became a major global energy source about two decades ago — signaling a potential shift in the momentum of renewable deployment growth. OilPrice.com

5. What caused this slowdown?

The decline is attributed to policy shifts and slowing demand in major markets, especially in countries like China and the U.S., where earlier booming growth is moderating. S&P Global+1

This article is for informational purposes only.

Reference: https://www.bloomberg.com/news/articles/2025-12-16/global-solar-additions-to-fall-for-first-time-in-2026-says-bnef

The post Global Solar Additions to Fall for First Time in 2026 appeared first on Green.org.