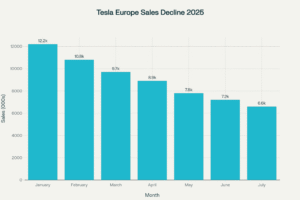

Tesla’s struggles in Europe hit a new low in July 2025, with sales collapsing by 40% year-on-year. According to data from the European Automobile Manufacturers’ Association (ACEA), Tesla (TSLA) registered just 8,837 vehicles across the EU, UK, and EFTA. That marked Tesla’s seventh consecutive month of decline, even as the broader electric vehicle (EV) market expanded.

In stark contrast, Chinese rival BYD posted a 225% surge in registrations, hitting 13,503 units and overtaking Tesla in monthly sales for the first time on European soil. The result highlights how quickly the competitive balance is shifting in one of the world’s most important EV markets.

BYD Edges Out Tesla With Cheaper EVs in Europe

The July numbers were historic. Tesla, once seen as the face of Europe’s EV transition, slid to a mere 0.7% market share, while BYD (BYDDY) climbed to 1.1%. One major issue is Tesla’s aging lineup. The Model 3 and Model Y, once revolutionary, now feel stale compared to fresh, feature-packed EVs from competitors.

Notably, BYD has been expanding its European presence with new showrooms, competitive pricing, and hybrid options that cater to cost-conscious buyers. Its strong growth also reflects Europe’s appetite for affordable EVs, an area where Tesla has yet to deliver fully.

Tesla’s cost cuts don’t match the low prices from BYD and other Chinese EV makers. These rivals have better supply chains, allowing them to sell cheaper cars without damaging their profits as much.

For Tesla, the decline underscores a widening gap between brand prestige and consumer demand. While Musk’s company still dominates in the U.S., Europe has become a tougher battleground.

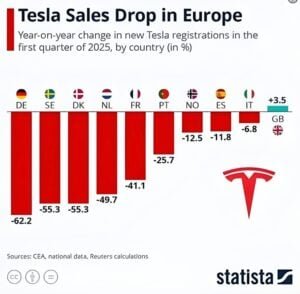

Country-Level Trends Show Tesla’s Weakness

Tesla’s slump is evident across major European markets:

-

Germany – Europe’s largest EV market saw rising BEV demand, but Tesla’s share shrank as Volkswagen and BMW expanded their electric lineups.

-

France – National registrations of hybrids and EVs grew, yet Tesla’s numbers fell, reflecting reputational challenges and stronger competition from Renault.

-

Nordic countries (Sweden, Denmark, Norway) – Once core Tesla strongholds, these markets saw double-digit declines as consumers pivoted to newer, more affordable alternatives.

-

Spain and Italy – Plug-in hybrid sales surged in both countries, but Tesla’s BEV registrations didn’t benefit, further highlighting the brand’s challenges.

In each case, Tesla is losing ground not just to BYD but also to legacy automakers that have quickly adjusted to consumer preferences.

Rivals Gain While Tesla Slips

Tesla’s July decline wasn’t shared by the rest of the market. In fact, overall battery-electric vehicle sales rose 33.6% year-on-year across Europe. Several automakers gained momentum:

-

Volkswagen Group: Sales up 11.6%, with strong demand for its ID. series.

-

BMW: Up 11.6%, boosted by the Mini brand’s 41% jump in registrations.

-

Renault: Continued to grow its EV base, capitalizing on the mid-range market Tesla has largely ignored.

Meanwhile, Stellantis, Hyundai, Toyota, and Suzuki joined Tesla on the losing side, posting year-over-year declines. The divergence shows that while the EV market is still expanding, success depends on fresh offerings and competitive positioning.

In the case of Tesla, it seems to have missed shifting demand trends. European drivers are gravitating toward hybrids and smaller, affordable EVs, while Tesla continues to lean heavily on its premium lineup. This mismatch means Tesla is shrinking while the overall EV market keeps expanding.

The end result: Europe’s EV race is heating up, but Tesla is no longer leading the charge.

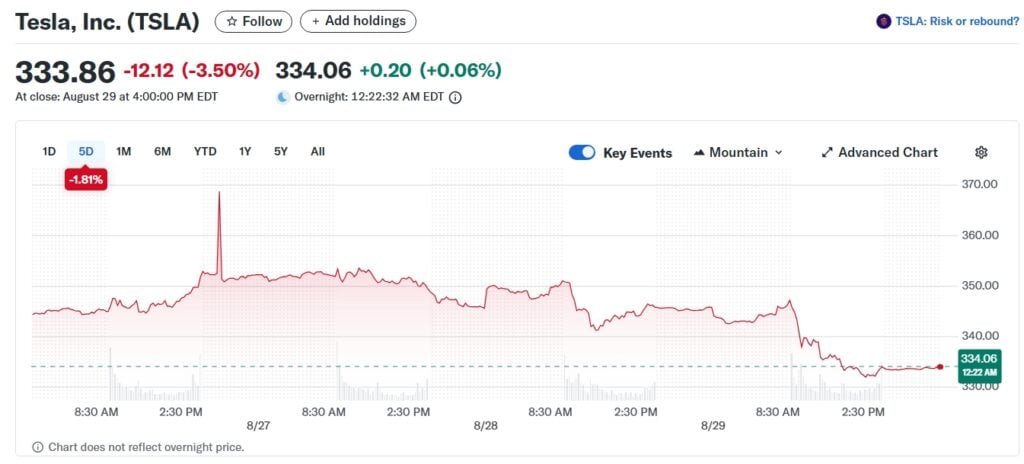

TSLA Stock Under Pressure

Tesla shares fell 3.5% after a 40% drop in July European EV registrations. The decline underscored tough competition and weakening demand in a critical market.

Analysts see the stock caught in a tight range, with resistance near $350 and support around $330. A breakout higher would need stronger delivery results or product news, while continued sales weakness could drive further losses.

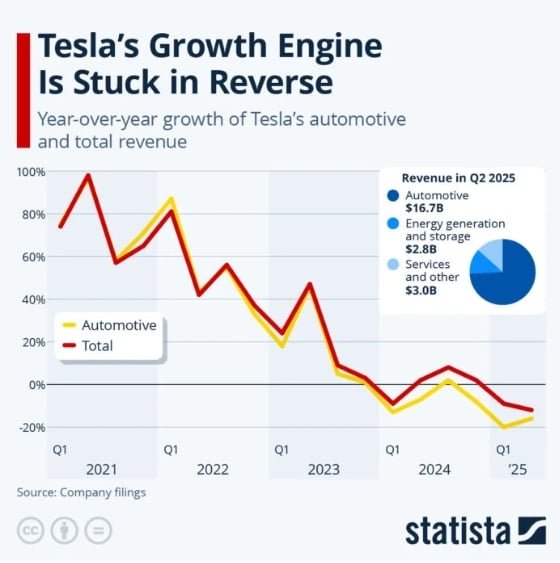

In this context, in Q2 2025, the company reported:

-

Revenue: $22.5 billion, down 12% year-on-year.

-

Net income: $1.17 billion, down 16%, pressured by price cuts and weaker deliveries.

-

Deliveries: 384,122 vehicles, a 14% drop from Q2 2024.

The earnings miss highlighted Tesla’s vulnerability to slowing sales in both Europe and China, where demand also slipped. Even the long-awaited Cybertruck has not met expectations.

Tesla’s next big drivers could be delivery numbers, regulatory changes, and progress in AI and Full Self-Driving (FSD). These will determine whether TSLA stock moves higher or stays flat.

Right now, analysts see resistance around $348–$350 and support near $330. Market sentiment is divided, with some optimistic about growth while others remain skeptical.

Can Tesla Win Back Europe’s Trust?

Musk has promised a new low-cost EV that could enter volume production in late 2025. If delivered on time, the model could help Tesla regain relevance in Europe’s highly competitive entry-level segment.

However, skepticism remains high. Production delays have plagued Tesla in the past, and with BYD, Volkswagen, and Renault already entrenched in the affordable EV space, Tesla’s late entry may not be enough to reverse its slide.

Furthermore, the brand’s reputation has also taken a hit. Elon Musk’s strong political views had upset many Europeans. Protests, boycotts, and negative headlines have weakened Tesla’s loyal fan base across the continent.

Europe’s EV market is booming, but it’s now evident that Tesla is losing ground. Notably. July drop was its seventh straight monthly decline, pointing to deeper problems with pricing, products, and perception.

To recover, Musk’s EVs need more than AI promises—they must deliver new models, competitive prices, and most importantly, rebuild consumer trust. For now, Europe shows that even an EV pioneer like Tesla can lose momentum.

The post Tesla’s Europe Sales Crash 40% in July as BYD Surges Ahead Again! appeared first on Carbon Credits.